Industry Statistics and Rankings

How does this industry perform in Austria compared to Europe?

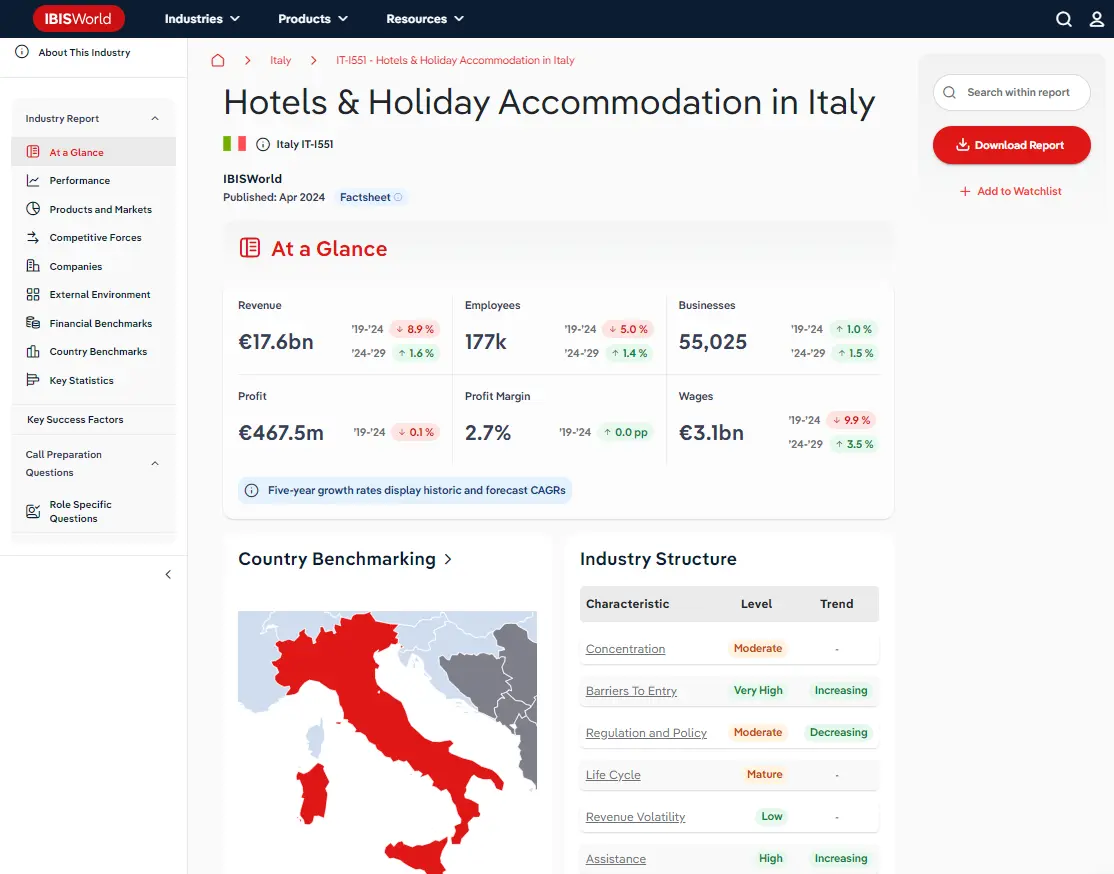

Country Benchmarking

Industry Data Austria

Ranking are out of 37 European countries for which IBISWorld provides country-level factsheets.

Revenue

#4 In EuropeBusiness

#18 In EuropeEmployees

#7 In EuropeWages

#2 In EuropeRevenue prospects for the Lifting and Handling Equipment Manufacturing industry largely depend on the performance of downstream manufacturing, freight-handling and construction industries and their business expenditure levels. Similarly, large-scale manufacturers with multiple production facilities across Europe rely on a substantial share of export revenue to drive sales, with exports representing around 70% of industry revenue. Growing demand for warehouse and storage propelled revenue growth in the lead-up to the pandemic, while weak business sentiment during hindered revenue growth somewhat.

Enterprises

Number of businesses in 2024

Biggest companies in the Lifting & Handling Equipment Manufacturing in Austria

| Company | Market Share (%)

2024 | Revenue (€m)

2024 | Profit (€m)

2024 | Profit Margin (%)

2024 |

|---|---|---|---|---|

Jungheinrich AG | 5,228.7 | 484.0 | 9.3 |

Access statistics and analysis on all 1 companies with purchase. View purchase options.

Top Questions Answered in this Report

Unlock comprehensive answers and precise data upon purchase. View purchase options.

What is the market size of the Lifting & Handling Equipment Manufacturing industry in Austria in 2024?

The market size of the Lifting & Handling Equipment Manufacturing industry in Austria is €7.0bn in 2024.

How many businesses are there in the Lifting & Handling Equipment Manufacturing in Austria industry in 2024?

There are 119 businesses in the Lifting & Handling Equipment Manufacturing industry in Austria, which has declined at a CAGR of 2.1 % between 2019 and 2024.

Has the Lifting & Handling Equipment Manufacturing industry in Austria grown or declined over the past 5 years?

The market size of the Lifting & Handling Equipment Manufacturing industry in Austria has been growing at a CAGR of 1.8 % between 2019 and 2024.

What is the forecast growth of the Lifting & Handling Equipment Manufacturing industry in Austria over the next 5 years?

Over the next five years, the Lifting & Handling Equipment Manufacturing industry in Austria is expected to grow.

What are the biggest companies in the Lifting & Handling Equipment Manufacturing market in Austria?

The biggest company operating in the Lifting & Handling Equipment Manufacturing market in Austria is Jungheinrich AG

What does the Lifting & Handling Equipment Manufacturing in Austria include?

Industrial trucks and Crane systems are part of the Lifting & Handling Equipment Manufacturing industry.

Which companies have the highest market share in the Lifting & Handling Equipment Manufacturing in Austria?

The company holding the most market share in Austria is Jungheinrich AG.

How competitive is the Lifting & Handling Equipment Manufacturing industry in Austria?

The level of competition is moderate and steady in the Lifting & Handling Equipment Manufacturing industry in Austria.

Related Industries

This industry is covered in 37 countries

Domestic industries

Competitors

- Other Special-Purpose Machinery Manufacturing in Austria

Complementors

- Engine & Turbine Manufacturing in Austria

Table of Contents

About this industry

Industry definition

Companies in the industry manufacture lifting and handling equipment, including hand-operated or power-driven lifting, handling, loading or unloading machinery. The production of conveyors, lifts, escalators, moving walkways and specialised parts for lifting and handling equipment is also part of the industry.

Related Terms

CraneLifting GearWinchWhat's included in this industry?

Industrial trucksCrane systemsLifting systemsContinuous conveyorElevators & escalatorsCompanies

Jungheinrich AGIndustry Code

2816 - Manufacture of lifting and handling equipment in Austria

View up to 1 companies with purchase. View purchase options.

Performance

Revenue Highlights

Trends

- Revenue

- 2024 Revenue Growth

- Revenue Volatility

Employment Highlights

Trends

- Employees

- Employees per Business

- Revenue per Employee

Business Highlights

Trends

- Businesses

- Employees per Business

- Revenue per Business

Profit Highlights

Trends

- Total Profit

- Profit Margin

- Profit per Business

Current Performance

Charts

- Revenue

- Employees

- Business

- Profit

Analysis

What's driving current industry performance in the Lifting & Handling Equipment Manufacturing in Austria industry?

Outlook

Analysis

What's driving the Lifting & Handling Equipment Manufacturing in Austria industry outlook?

Volatility

Analysis

What influences volatility in the Lifting & Handling Equipment Manufacturing in Austria industry?

Charts

- Industry Volatility vs. Revenue Growth Matrix

Life Cycle

Analysis

What determines the industry life cycle stage in the Lifting & Handling Equipment Manufacturing in Austria industry?

Charts

- Industry Life Cycle Matrix

Products and Markets

Highlights

Trends

- Largest Market

- Product Innovation

Key Takeaways

Recovering downstream markets boosts demand for industrial trucks. As pandemic-related disruptions eased over 2022 and 2023, export sales of the industry's most lucrative product, forklifts, expanded as global logistics and manufacturing sectors boosted capacity.

Products and Services

Charts

- Products and Services Segmentation

Analysis

How are the Lifting & Handling Equipment Manufacturing in Austria industry's products and services performing?

Analysis

What are innovations in the Lifting & Handling Equipment Manufacturing in Austria industry's products and services?

Major Markets

Charts

- Major Market Segmentation

Analysis

What influences demand in the Lifting & Handling Equipment Manufacturing in Austria industry?

International Trade

Highlights

- Total Imports into Austria

- Total Exports into Austria

Heat maps

- Industry Concentration of Imports by Country

- Industry Concentration of Exports by Country

Data Tables

Value and annual change (%) included

- Number of Imports and Exports by European Country (2024)

Competitive Forces

Highlights

Trends

- Concentration

- Competition

- Barriers to Entry

- Substitutes

- Buyer Power

- Supplier Power

Key Takeaways

The largest manufacturers export products globally. Despite having a low market share concentration, a handful of manufacturers dominate industry exports and have secured economies of scale by setting up manufacturing facilities across Europe.

Supply Chain

Charts

Buyer and supply industries

Geographic Breakdown

Business Locations

Heat maps

- Share of Total Industry Establishments by Region (2024)

Data Tables

- Number of Establishments by Region (2024)

Charts

- Share of Establishments vs. Population of Each Region

Analysis

What regions are businesses in the Lifting & Handling Equipment Manufacturing in Austria located?

Companies

Data Tables

Top 1 companies by market share:

- Market share (2024)

- Revenue (2024)

- Profit (2024)

- Profit margin (2024)

External Environment

Highlights

Trends

- Regulation & Policy

- Assistance

Key Takeaways

Manufacturers must abide by European standards. These are the EN 81-20 and EN 81-50 standards. The EN 81-20 standard regulates elevators' design and technical characteristics. Elevator testing must comply with the EN 81-50 standard.

External Drivers

Analysis

What demographic and macroeconomic factors impact the Lifting & Handling Equipment Manufacturing in Austria industry?

Financial Benchmarks

Highlights

Trends

- Profit Margin

- Average Wage

- Largest Cost

Key Takeaways

Purchases costs skyrocket as demand outstrips supply. Over 2021, the world price of steel skyrocketed more than doubling while aluminium prices soared. Excess demand raised the cost of inputs throughout the supply chain, elevating purchase costs over 2021 and 2022.

Cost Structure

Charts

- Share of Economy vs. Investment Matrix

-

Industry Cost Structure Benchmarks:

- Marketing

- Depreciation

- Profit

- Purchases

- Wages

- Rent

- Utilities

- Other

Analysis

What trends impact cost in the Lifting & Handling Equipment Manufacturing in Austria industry?

Key Ratios

Data tables

- IVA/Revenue (2014-2029)

- Imports/Demand (2014-2029)

- Exports/Revenue (2014-2029)

- Revenue per Employee (2014-2029)

- Wages/Revenue (2014-2029)

- Employees per Establishment (2014-2029)

- Average Wage (2014-2029)

Country Benchmarks

European Leaders & Laggards

Data Tables

Top and boottom five countries listed for each:

- Revenue Growth (2024)

- Business Growth (2024)

- Job Growth (2024)

European Country Performance

Data Tables

Rankings available for 37 countries. Statistics ranked include:

- IVA/Revenue (2024)

- Imports/Demand (2024)

- Exports/Revenue (2024)

- Revenue per Employee (2024)

- Wages/Revenue (2024)

- Employees per Establishment (2024)

- Average Wage (2024)

Structural Comparison

Data Tables

Trends in 37 countries benchmarked against trends in Europe

- Concentration

- Competition

- Barriers to Entry

- Buyer Power

- Supplier Power

- Volatility

- Capital Intensity

- Innovation

- Life Cycle

Key Statistics

Industry Data

Data Tables

Including values and annual change:

- Revenue (2014-2029)

- IVA (2014-2029)

- Establishments (2014-2029)

- Enterprises (2014-2029)

- Employment (2014-2029)

- Exports (2014-2029)

- Imports (2014-2029)

- Wages (2014-2029)

Methodology

Where does IBISWorld source its data?

IBISWorld is a world-leading provider of business information, with reports on 5,000+ industries in Australia, New Zealand, North America, Europe and China. Our expert industry analysts start with official, verified and publicly available sources of data to build an accurate picture of each industry.

Each industry report incorporates data and research from government databases, industry-specific sources, industry contacts, and IBISWorld's proprietary database of statistics and analysis to provide balanced, independent and accurate insights.

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools.

To learn more about specific data sources used by IBISWorld's analysts globally, including how industry data forecasts are produced, visit our Help Center.

France

France

Italy

Italy

Spain

Spain