Industry Statistics and Rankings

How does this industry perform in Italy compared to Europe?

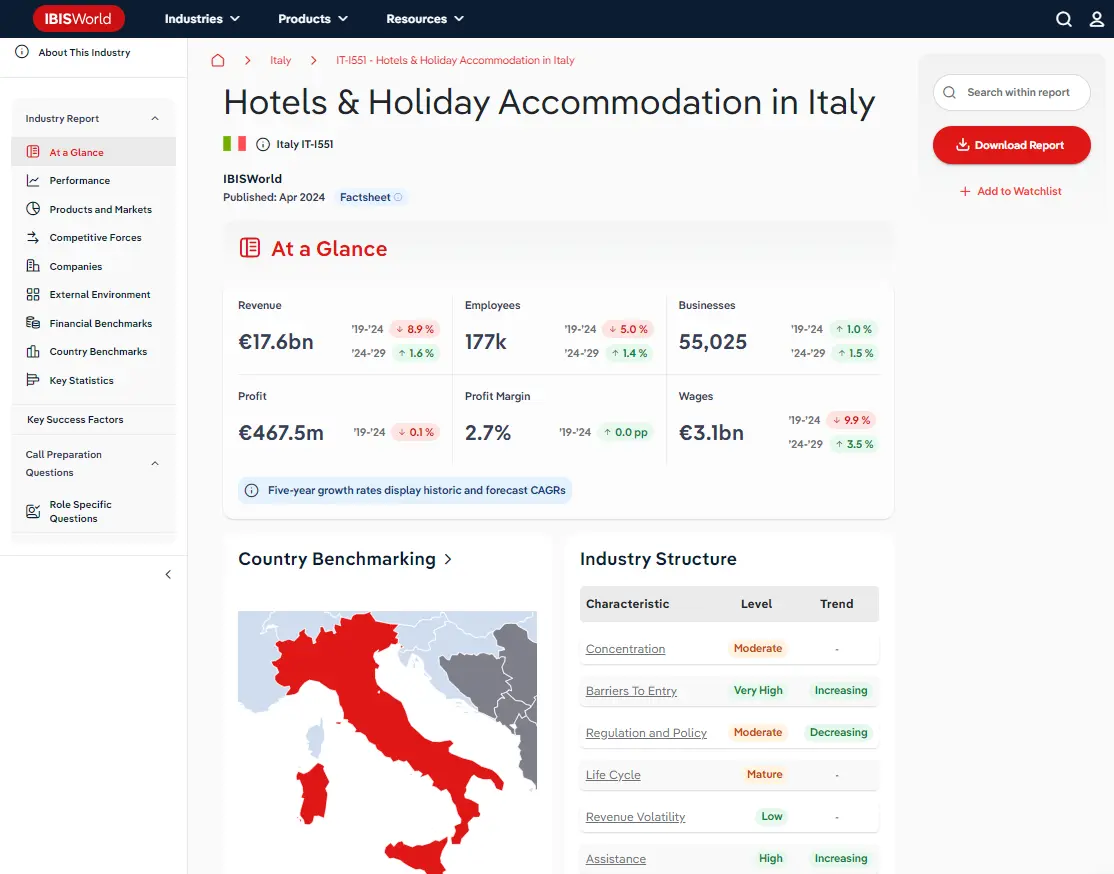

Country Benchmarking

Industry Data Italy

Ranking are out of 37 European countries for which IBISWorld provides country-level factsheets.

Revenue

#2 In EuropeBusiness

#2 In EuropeEmployees

#1 In EuropeWages

#2 In EuropeEuropean oven, furnace and burner manufacturers have battled numerous headwinds in recent years. In 2020, the pandemic restricted output capacity, with many downstream markets postponing orders amid uncertain economic conditions. Spain and the UK were the most impacted by extensive lockdowns and stringent COVID-19 restrictions, with manufacturers suffering from substantial output drops. Similarly, soaring steel prices have raised manufacturers operating cost base, exacerbated by the Russia-Ukraine conflict, while weak domestic and foreign downstream demand has lowered export growth and industry revenue.Over the five years through 2024, industry revenue is expected to tumble at a compound annual rate of 2.3% to €13.1 billion. Over 2021 and 2022, supply chain bottlenecks adversely impacted output volumes. Manufacturing couldn't keep up with soaring inflation, with output prices falling short of cost increases, causing industry revenue to drop by 6.7% in 2022. Similarly, the state of the global economy significantly impacts furnace and burner manufacturing, as exports account for most of the industry's revenue. Over 2024, industry revenue is expected to tumble by 3.8% because of weak order volumes downstream markets rein in capital spending amid a high-interest environment. Over the five years through 2029, industry revenue is expected to expand at a compound annual rate of 1.7% to reach €14.3 billion. The industry is moving towards greener solutions as EU and Europe push for stronger environmental regulations. European manufacturers will continue pouring money into R&D to create energy-efficient furnaces and burners, focusing on reducing the overall carbon footprint, enhancing productivity and significantly cutting operational costs. On the product side, AI and IoT technologies will revolutionise the sector by providing clients with comprehensive data analytics on the performance of their furnaces and ovens, reducing furnace downtime and enhancing overall fuel efficiency for clients.

Enterprises

Number of businesses in 2024

Biggest companies in the Oven, Furnace & Furnace Burner Manufacturing in Italy

| Company | Market Share (%)

2024 | Revenue (€m)

2024 | Profit (€m)

2024 | Profit Margin (%)

2024 |

|---|---|---|---|---|

SMS Holding GmbH | 3,460.4 | 44.4 | 1.3 | |

Fives Group SAS | 2,954.1 | 87.0 | 2.9 | |

Ferroli SpA | 465.8 | 44.2 | 9.5 |

Access statistics and analysis on all 4 companies with purchase. View purchase options.

Top Questions Answered in this Report

Unlock comprehensive answers and precise data upon purchase. View purchase options.

What is the market size of the Oven, Furnace & Furnace Burner Manufacturing industry in Italy in 2024?

The market size of the Oven, Furnace & Furnace Burner Manufacturing industry in Italy is €3.2bn in 2024.

How many businesses are there in the Oven, Furnace & Furnace Burner Manufacturing in Italy industry in 2024?

There are 443 businesses in the Oven, Furnace & Furnace Burner Manufacturing industry in Italy, which has grown at a CAGR of 0.5 % between 2019 and 2024.

Has the Oven, Furnace & Furnace Burner Manufacturing industry in Italy grown or declined over the past 5 years?

The market size of the Oven, Furnace & Furnace Burner Manufacturing industry in Italy has been declining at a CAGR of 0.2 % between 2019 and 2024.

What is the forecast growth of the Oven, Furnace & Furnace Burner Manufacturing industry in Italy over the next 5 years?

Over the next five years, the Oven, Furnace & Furnace Burner Manufacturing industry in Italy is expected to grow.

What are the biggest companies in the Oven, Furnace & Furnace Burner Manufacturing market in Italy?

The biggest companies operating in the Oven, Furnace & Furnace Burner Manufacturing market in Italy are SMS Holding GmbH, Fives Group SAS and Ferroli SpA

What does the Oven, Furnace & Furnace Burner Manufacturing in Italy include?

Electric furnaces and ovens and Parts for furnaces and ovens are part of the Oven, Furnace & Furnace Burner Manufacturing industry.

Which companies have the highest market share in the Oven, Furnace & Furnace Burner Manufacturing in Italy?

The company holding the most market share in Italy is SMS Holding GmbH.

How competitive is the Oven, Furnace & Furnace Burner Manufacturing industry in Italy?

The level of competition is moderate and increasing in the Oven, Furnace & Furnace Burner Manufacturing industry in Italy.

Related Industries

This industry is covered in 37 countries

Domestic industries

Competitors

- Other Special-Purpose Machinery Manufacturing in Italy

- Food & Drink Processing Machinery Manufacturing in Italy

Complementors

- Medical & Dental Instrument & Supplies Manufacturing in Italy

- Electrical Household Appliance Manufacturing in Italy

Table of Contents

About this industry

Industry definition

Companies in this industry manufacture electrical and other industrial furnaces, burners and ovens, including incinerators for industrial and domestic use and other thermal equipment. The industry does not include the manufacture of household electric stoves and ovens, central heating radiators and boilers, solar cells, solar panels and dryers.

Related Terms

ARC FURNACELABORATORY FURNACEVACUUM FURNACEWhat's included in this industry?

Electric furnaces and ovensParts for furnaces and ovensBurnersNon electric furnaces and ovens for roasting and meltingOther productsCompanies

SMS Holding GmbHFives Group SASFerroli SpAIndustry Code

2815 - Manufacture of ovens, furnaces and furnace burners in Italy

View up to 4 companies with purchase. View purchase options.

Performance

Revenue Highlights

Trends

- Revenue

- 2024 Revenue Growth

- Revenue Volatility

Employment Highlights

Trends

- Employees

- Employees per Business

- Revenue per Employee

Business Highlights

Trends

- Businesses

- Employees per Business

- Revenue per Business

Profit Highlights

Trends

- Total Profit

- Profit Margin

- Profit per Business

Current Performance

Charts

- Revenue

- Employees

- Business

- Profit

Analysis

What's driving current industry performance in the Oven, Furnace & Furnace Burner Manufacturing in Italy industry?

Outlook

Analysis

What's driving the Oven, Furnace & Furnace Burner Manufacturing in Italy industry outlook?

Volatility

Analysis

What influences volatility in the Oven, Furnace & Furnace Burner Manufacturing in Italy industry?

Charts

- Industry Volatility vs. Revenue Growth Matrix

Life Cycle

Analysis

What determines the industry life cycle stage in the Oven, Furnace & Furnace Burner Manufacturing in Italy industry?

Charts

- Industry Life Cycle Matrix

Products and Markets

Highlights

Trends

- Largest Market

- Product Innovation

Key Takeaways

Soaring demand for metal production lifts orders. Soaring metal prices have increased demand for electric furnaces as downstream metal processors and producers rush to benefit from higher market prices.

Products and Services

Charts

- Products and Services Segmentation

Analysis

How are the Oven, Furnace & Furnace Burner Manufacturing in Italy industry's products and services performing?

Analysis

What are innovations in the Oven, Furnace & Furnace Burner Manufacturing in Italy industry's products and services?

Major Markets

Charts

- Major Market Segmentation

Analysis

What influences demand in the Oven, Furnace & Furnace Burner Manufacturing in Italy industry?

International Trade

Highlights

- Total Imports into Italy

- Total Exports into Italy

Heat maps

- Industry Concentration of Imports by Country

- Industry Concentration of Exports by Country

Data Tables

Value and annual change (%) included

- Number of Imports and Exports by European Country (2024)

Competitive Forces

Highlights

Trends

- Concentration

- Competition

- Barriers to Entry

- Substitutes

- Buyer Power

- Supplier Power

Key Takeaways

The industry is highly fragmented. The industry is characterised by a high degree of fragmentation thanks to the broad product portfolio and the large number of customers with diverse needs.

Supply Chain

Charts

Buyer and supply industries

Geographic Breakdown

Business Locations

Heat maps

- Share of Total Industry Establishments by Region (2024)

Data Tables

- Number of Establishments by Region (2024)

Charts

- Share of Establishments vs. Population of Each Region

Analysis

What regions are businesses in the Oven, Furnace & Furnace Burner Manufacturing in Italy located?

Companies

Data Tables

Top 4 companies by market share:

- Market share (2024)

- Revenue (2024)

- Profit (2024)

- Profit margin (2024)

External Environment

Highlights

Trends

- Regulation & Policy

- Assistance

Key Takeaways

Manufacturers must abide by EU and national product standards and regulations. For example, the most essential set of rules for the commercial use of heat pumps is EU Regulation 517/2014 on hydrofluorocarbons.

External Drivers

Analysis

What demographic and macroeconomic factors impact the Oven, Furnace & Furnace Burner Manufacturing in Italy industry?

Financial Benchmarks

Highlights

Trends

- Profit Margin

- Average Wage

- Largest Cost

Key Takeaways

Large-scale manufacturers protect themselves against input inflation. Some large-scale manufacturers have managed to at least partially offload higher steel prices on downstream consumers or hedge against input price fluctuations via long-term fixed-price supply contracts.

Cost Structure

Charts

- Share of Economy vs. Investment Matrix

-

Industry Cost Structure Benchmarks:

- Marketing

- Depreciation

- Profit

- Purchases

- Wages

- Rent

- Utilities

- Other

Analysis

What trends impact cost in the Oven, Furnace & Furnace Burner Manufacturing in Italy industry?

Key Ratios

Data tables

- IVA/Revenue (2014-2029)

- Imports/Demand (2014-2029)

- Exports/Revenue (2014-2029)

- Revenue per Employee (2014-2029)

- Wages/Revenue (2014-2029)

- Employees per Establishment (2014-2029)

- Average Wage (2014-2029)

Country Benchmarks

European Leaders & Laggards

Data Tables

Top and boottom five countries listed for each:

- Revenue Growth (2024)

- Business Growth (2024)

- Job Growth (2024)

European Country Performance

Data Tables

Rankings available for 37 countries. Statistics ranked include:

- IVA/Revenue (2024)

- Imports/Demand (2024)

- Exports/Revenue (2024)

- Revenue per Employee (2024)

- Wages/Revenue (2024)

- Employees per Establishment (2024)

- Average Wage (2024)

Structural Comparison

Data Tables

Trends in 37 countries benchmarked against trends in Europe

- Concentration

- Competition

- Barriers to Entry

- Buyer Power

- Supplier Power

- Volatility

- Capital Intensity

- Innovation

- Life Cycle

Key Statistics

Industry Data

Data Tables

Including values and annual change:

- Revenue (2014-2029)

- IVA (2014-2029)

- Establishments (2014-2029)

- Enterprises (2014-2029)

- Employment (2014-2029)

- Exports (2014-2029)

- Imports (2014-2029)

- Wages (2014-2029)

Methodology

Where does IBISWorld source its data?

IBISWorld is a world-leading provider of business information, with reports on 5,000+ industries in Australia, New Zealand, North America, Europe and China. Our expert industry analysts start with official, verified and publicly available sources of data to build an accurate picture of each industry.

Each industry report incorporates data and research from government databases, industry-specific sources, industry contacts, and IBISWorld's proprietary database of statistics and analysis to provide balanced, independent and accurate insights.

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools.

To learn more about specific data sources used by IBISWorld's analysts globally, including how industry data forecasts are produced, visit our Help Center.

France

France

Italy

Italy

Spain

Spain