Industry Statistics and Rankings

How does this industry perform in Austria compared to Europe?

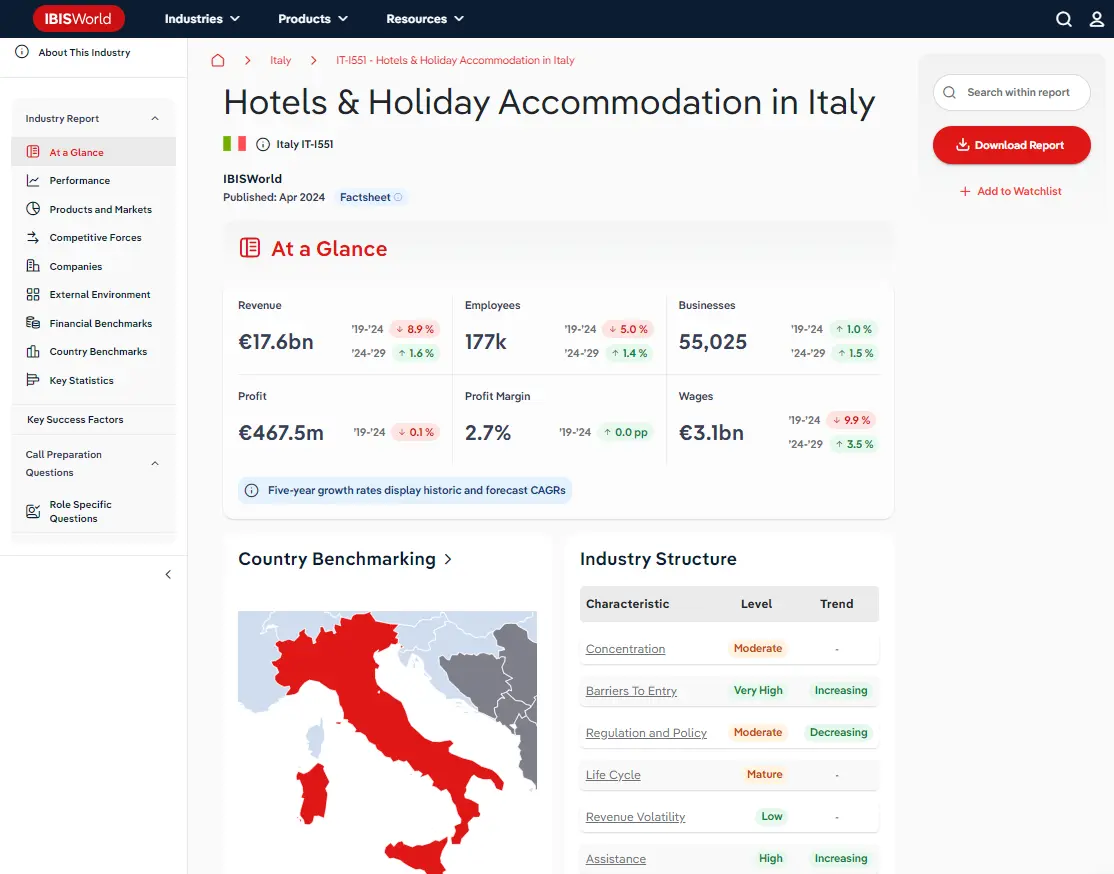

Country Benchmarking

Industry Data Austria

Ranking are out of 37 European countries for which IBISWorld provides country-level factsheets.

Revenue

#12 In EuropeBusiness

#18 In EuropeEmployees

#10 In EuropeWages

#7 In EuropeAgricultural product wholesalers contend with volatile crop yields and global commodity prices, changing government agricultural policies and changing customer demands. Over the five years through 2024, wholesalers’ revenue is forecast to grow at a compound annual rate of 2.9% to reach €489 billion. The Russia-Ukraine conflict has introduced severe disruption to global commodity supply chains, driving huge price rises for wheat, other grains and fertilisers. In the EU, the average price of agricultural products soared by 24% between 2021 and 2022, according to Eurostat - cereal price inflation of over 40% was a key driver of this. Put off by sky-high prices, major buyers of cereal-based feedstuffs have sought out alternatives, contributing to a drop in demand and driving a sharp drop in prices (-18.4%) in the UK over the year through September 2023, as shown by data from the Office for National Statistics. In 2024, wholesalers’ sales will be dampened by low business sentiment, but high prices will keep revenue growing – it’s expected to climb by 0.8%.

Enterprises

Number of businesses in 2024

Biggest companies in the Agricultural Product Wholesaling in Austria

| Company | Market Share (%)

2024 | Revenue (€m)

2024 | Profit (€m)

2024 | Profit Margin (%)

2024 |

|---|---|---|---|---|

Bunge Ltd. | 64,243.9 | 2,028.9 | 3.2 | |

AGRAVIS Raiffeisen AG | 8,004.0 | 39.0 | 0.5 |

Access statistics and analysis on all 2 companies with purchase. View purchase options.

Top Questions Answered in this Report

Unlock comprehensive answers and precise data upon purchase. View purchase options.

What is the market size of the Agricultural Product Wholesaling industry in Austria in 2024?

The market size of the Agricultural Product Wholesaling industry in Austria is €9.4bn in 2024.

How many businesses are there in the Agricultural Product Wholesaling in Austria industry in 2024?

There are 791 businesses in the Agricultural Product Wholesaling industry in Austria, which has declined at a CAGR of 1.0 % between 2019 and 2024.

Has the Agricultural Product Wholesaling industry in Austria grown or declined over the past 5 years?

The market size of the Agricultural Product Wholesaling industry in Austria has been declining at a CAGR of 3.1 % between 2019 and 2024.

What is the forecast growth of the Agricultural Product Wholesaling industry in Austria over the next 5 years?

Over the next five years, the Agricultural Product Wholesaling industry in Austria is expected to grow.

What are the biggest companies in the Agricultural Product Wholesaling market in Austria?

The biggest companies operating in the Agricultural Product Wholesaling market in Austria are Bunge Ltd. and AGRAVIS Raiffeisen AG

What does the Agricultural Product Wholesaling in Austria include?

Grain, seeds and tobacco and Animal feeds and raw materials are part of the Agricultural Product Wholesaling industry.

Which companies have the highest market share in the Agricultural Product Wholesaling in Austria?

The company holding the most market share in Austria is Bunge Ltd..

How competitive is the Agricultural Product Wholesaling industry in Austria?

The level of competition is moderate and steady in the Agricultural Product Wholesaling industry in Austria.

Related Industries

This industry is covered in 37 countries

Domestic industries

Competitors

- Meat Processing in Austria

- Seafood Processing in Austria

Complementors

- Machinery, Equipment & Supplies Wholesaling in Austria

- Supermarkets & Grocery Stores in Austria

Table of Contents

About this industry

Industry definition

Companies in this industry wholesale a wide variety of raw agricultural materials and live animals. Products include grains and seeds, unmanufactured tobacco, flowers, plants, oleaginous fruits, animal feed, hides, skins, leather and agricultural raw materials, including wool, hemp, cotton and animal hair. Companies primarily sell products to manufacturers and retailers.

Related Terms

OLEAGINOUS FRUITPERISHABLE COOPERATIVE FARMINGWhat's included in this industry?

Grain, seeds and tobaccoAnimal feeds and raw materialsFlowers and plantsLive animalsHides, skins and leatherCompanies

Bunge Ltd.AGRAVIS Raiffeisen AGIndustry Code

462 - Wholesale of agricultural raw materials and live animals in Austria

View up to 2 companies with purchase. View purchase options.

Performance

Revenue Highlights

Trends

- Revenue

- 2024 Revenue Growth

- Revenue Volatility

Employment Highlights

Trends

- Employees

- Employees per Business

- Revenue per Employee

Business Highlights

Trends

- Businesses

- Employees per Business

- Revenue per Business

Profit Highlights

Trends

- Total Profit

- Profit Margin

- Profit per Business

Current Performance

Charts

- Revenue

- Employees

- Business

- Profit

Analysis

What's driving current industry performance in the Agricultural Product Wholesaling in Austria industry?

Outlook

Analysis

What's driving the Agricultural Product Wholesaling in Austria industry outlook?

Volatility

Analysis

What influences volatility in the Agricultural Product Wholesaling in Austria industry?

Charts

- Industry Volatility vs. Revenue Growth Matrix

Life Cycle

Analysis

What determines the industry life cycle stage in the Agricultural Product Wholesaling in Austria industry?

Charts

- Industry Life Cycle Matrix

Products and Markets

Highlights

Trends

- Largest Market

- Product Innovation

Key Takeaways

Cereal prices soar following the Russia-Ukraine conflict. Wholesalers contended with sky-high prices of cereals for most of 2022 and 2023, limiting demand from buyers looking to avoid high costs.

Products and Services

Charts

- Products and Services Segmentation

Analysis

How are the Agricultural Product Wholesaling in Austria industry's products and services performing?

Analysis

What are innovations in the Agricultural Product Wholesaling in Austria industry's products and services?

Major Markets

Charts

- Major Market Segmentation

Analysis

What influences demand in the Agricultural Product Wholesaling in Austria industry?

International Trade

Highlights

- Total Imports into Austria

- Total Exports into Austria

Heat maps

- Industry Concentration of Imports by Country

- Industry Concentration of Exports by Country

Data Tables

Value and annual change (%) included

- Number of Imports and Exports by European Country (2024)

Competitive Forces

Highlights

Trends

- Concentration

- Competition

- Barriers to Entry

- Substitutes

- Buyer Power

- Supplier Power

Key Takeaways

A handful of players dominate some segments of the market. Companies like Cargill, ADM and LDC are well-established with a stronghold on certain products, but other parts of the market are more fragmented.

Supply Chain

Charts

Buyer and supply industries

Geographic Breakdown

Business Locations

Heat maps

- Share of Total Industry Establishments by Region (2024)

Data Tables

- Number of Establishments by Region (2024)

Charts

- Share of Establishments vs. Population of Each Region

Analysis

What regions are businesses in the Agricultural Product Wholesaling in Austria located?

Companies

Data Tables

Top 2 companies by market share:

- Market share (2024)

- Revenue (2024)

- Profit (2024)

- Profit margin (2024)

External Environment

Highlights

Trends

- Regulation & Policy

- Assistance

Key Takeaways

Agricultural policies have a strong hold on the industry. The EU’s Common Agricultural Policy shapes production levels and market dynamics, while environmental standards vary between the EU and non-EU countries.

External Drivers

Analysis

What demographic and macroeconomic factors impact the Agricultural Product Wholesaling in Austria industry?

Financial Benchmarks

Highlights

Trends

- Profit Margin

- Average Wage

- Largest Cost

Key Takeaways

Value-added services prop up profit. Most agricultural product wholesalers see limited returns because they need to set low prices to keep sales coming in, but offering extra services can generate additional profit.

Cost Structure

Charts

- Share of Economy vs. Investment Matrix

-

Industry Cost Structure Benchmarks:

- Marketing

- Depreciation

- Profit

- Purchases

- Wages

- Rent

- Utilities

- Other

Analysis

What trends impact cost in the Agricultural Product Wholesaling in Austria industry?

Key Ratios

Data tables

- IVA/Revenue (2014-2029)

- Imports/Demand (2014-2029)

- Exports/Revenue (2014-2029)

- Revenue per Employee (2014-2029)

- Wages/Revenue (2014-2029)

- Employees per Establishment (2014-2029)

- Average Wage (2014-2029)

Country Benchmarks

European Leaders & Laggards

Data Tables

Top and boottom five countries listed for each:

- Revenue Growth (2024)

- Business Growth (2024)

- Job Growth (2024)

European Country Performance

Data Tables

Rankings available for 37 countries. Statistics ranked include:

- IVA/Revenue (2024)

- Imports/Demand (2024)

- Exports/Revenue (2024)

- Revenue per Employee (2024)

- Wages/Revenue (2024)

- Employees per Establishment (2024)

- Average Wage (2024)

Structural Comparison

Data Tables

Trends in 37 countries benchmarked against trends in Europe

- Concentration

- Competition

- Barriers to Entry

- Buyer Power

- Supplier Power

- Volatility

- Capital Intensity

- Innovation

- Life Cycle

Key Statistics

Industry Data

Data Tables

Including values and annual change:

- Revenue (2014-2029)

- IVA (2014-2029)

- Establishments (2014-2029)

- Enterprises (2014-2029)

- Employment (2014-2029)

- Exports (2014-2029)

- Imports (2014-2029)

- Wages (2014-2029)

Methodology

Where does IBISWorld source its data?

IBISWorld is a world-leading provider of business information, with reports on 5,000+ industries in Australia, New Zealand, North America, Europe and China. Our expert industry analysts start with official, verified and publicly available sources of data to build an accurate picture of each industry.

Each industry report incorporates data and research from government databases, industry-specific sources, industry contacts, and IBISWorld's proprietary database of statistics and analysis to provide balanced, independent and accurate insights.

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools.

To learn more about specific data sources used by IBISWorld's analysts globally, including how industry data forecasts are produced, visit our Help Center.

France

France

Italy

Italy

Spain

Spain