Why Organisations Consistently React Too Late to Industry Change

Industry change is often noticed early, but organisations are structured to act only once the cost of waiting becomes undeniable.

Learn more330 valuation firms trust IBISWorld as their source of industry intelligence

110 expert, in-house analysts produce unbiased, human-verified data and analysis for you

3x more industries coveredthan other industry research providers

At IBISWorld, we believe in the power of unlocking answers to complex questions. With consistent data, historical trends and benchmarks on thousands of industries, you can build defensible models, support due diligence and deliver findings that stand up to scrutiny.

Trusted by

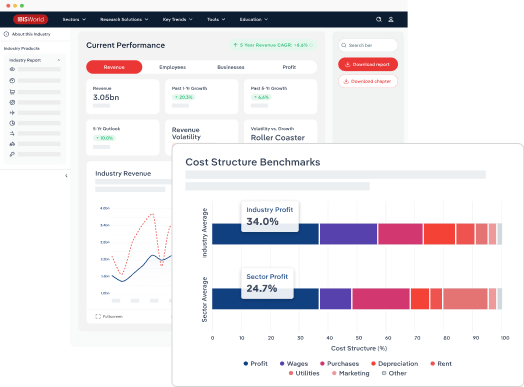

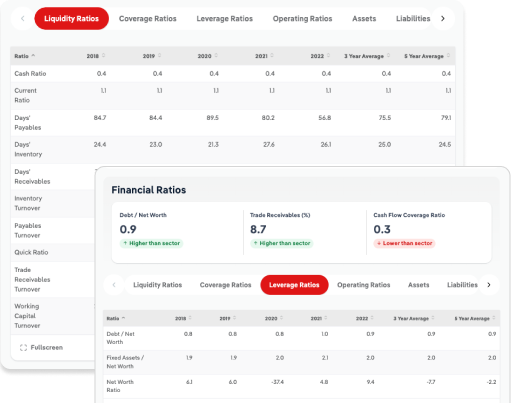

Building accurate valuation models depends on having standardized, reliable data you can trust. IBISWorld provides model-ready industry benchmarks, trends and financial metrics so you can build defensible valuations faster and with greater confidence.

Reviewing valuation reports takes time, and the pressure to ensure compliance and credibility is high. With consistent, well-documented data and clear sourcing at your fingertips, it’s easier to validate assumptions and ensure every report is grounded in industry-aligned insights.

Industry change is often noticed early, but organisations are structured to act only once the cost of waiting becomes undeniable.

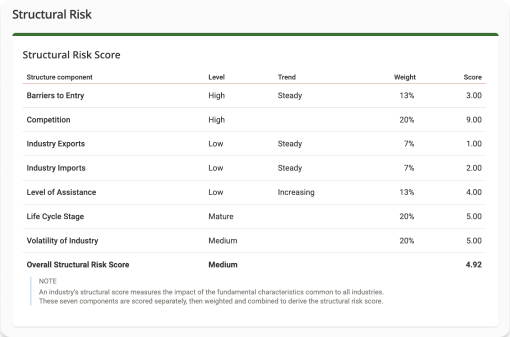

Learn moreRisk often becomes visible through early operational and market signals, but without context those signals are easy to dismiss until action is far more costly.

Learn moreASEAN integration and infrastructure investment are reshaping South-East Asia through 2031. For Australian companies, opportunity is growing, but risks remain uneven.

Learn moreValuations in litigation must be backed by objective, defensible evidence that stands up under scrutiny. IBISWorld delivers independent industry data, benchmarks and trend analysis to help you confidently support your conclusions—from early analysis to courtroom defense.

Model-ready information that withstands scrutiny.

Measure a target’s performance against independent benchmarks.

Understand a company’s operating environment.

We analyse companies with less than $10m in revenue across Australia to ensure you have information for smaller operators.

Learn about SME Industry ReportsGet a clear picture of the ESG risk environment for industries across Europe and Australia to meet mandatory reporting standards and evaluate your clients’ exposure to ESG risks.

Learn about ESG Risk AssessmentsDive into past industry reports for a clear understanding of industry trends and conditions at the time of a particular transaction.

Explore top-rated industry research tools and learn how to tackle business challenges with data.

A list of fast facts on the performance of each sector of the UK economy.

Defense-driven innovation are remaking the country’s economic foundation. See how the next decade of industrial growth is taking shape.

GLP 1 weight loss drugs could ease NHS pressure and lift productivity, but high costs, unequal access and uncertain outcomes pose economic risks for the UK.

Die Nachfrage nach biologisch erzeugten Lebensmitteln wächst in Deutschland deutlich schneller als die heimische Ökolandbaufläche, wodurch eine Versorgungslücke entsteht.

Social media platforms have turned feeds into checkout lanes, shifting power from storefronts to algorithms and creators.

Während ETFs Marktzugang und Gebühren grundlegend verändern, verschwimmt die Grenze zwischen aktivem und passivem Investieren zunehmend.

Risk often becomes visible through early operational and market signals, but without context those signals are easy to dismiss until action is far more costly.

Decision confidence often erodes when performance remains stable but the context needed to interpret it no longer holds.

Geopolitical rivalry is fragmenting global trade and supply chains. Australia must balance US alignment with economic reliance on China amid rising trade and sanction risks.