See the full picture of borrower risk

Look beyond cash flow and credit history to understand the external risks shaping your clients' industries.

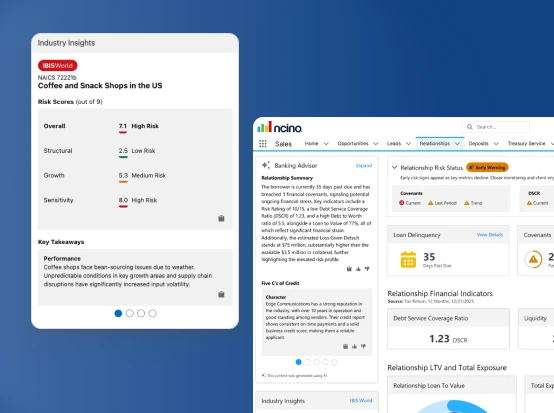

Anticipate lending risks

Evaluate how borrowers’ strategies address key industry risks and economic challenges.

- Understand your borrower’s unique risk landscape

- Stay ahead of external threats with a 12–18 month risk outlook

- Monitor portfolio risk by tracking industry trends affecting multiple loans

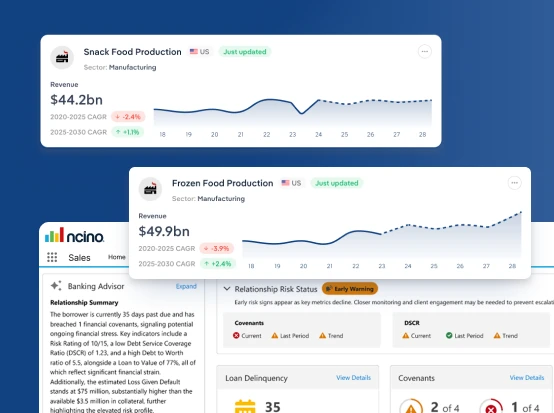

Elevate credit monitoring

Creditworthiness goes beyond cash flow and margin growth.

- Gauge industry stability before extending credit

- Spot sector-level risks that could impact repayment

- Support lending decisions with objective, third-party intelligence

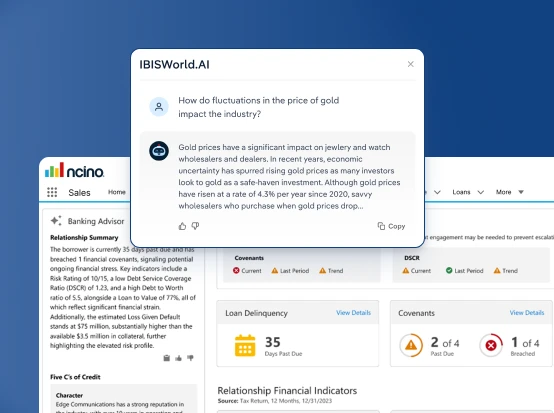

Fuel better client conversations

Strengthen relationships with actionable insights at every stage.

- Equip relationship managers with intuitive risk dashboards

- Empower your team to match banking products to clients’ industry-specific needs

- Build trust through transparent, data-backed discussions

Speak with an integration expert

Learn more about how integrating IBISWorld's data into your workflow can benefit your business.

FAQs

Can’t find the answer you’re looking for? Please reach out to our team or visit ncino.com.

Can IBISWorld integrate with internal systems like nCino or APIs?

The IBISWorld nCino integration allows users to access trusted industry intelligence directly within nCino. By embedding IBISWorld’s industry data and analyst insights into nCino, teams can make faster, data-driven decisions without switching platforms.

How can integrating IBISWorld data into nCino improve decision making?

Integrating IBISWorld data enhances nCino’s analytics by adding deep industry insights and market trends. This integration empowers sales, strategy, and credit teams to identify opportunities, assess risks, and forecast performance with greater confidence.

Is IBISWorld’s nCino integration secure for sharing and managing industry data?

IBISWorld’s nCino integration is designed with enterprise-grade security. It enables secure data sharing across teams while maintaining full control of access and permissions within nCino.

What types of industry insights can I access in nCino using IBISWorld data?

Users can access detailed industry analysis, performance benchmarks, key trends, and structured data directly in nCino. These insights help businesses understand market conditions, evaluate clients, and support data-driven strategy development.

How does IBISWorld connect with nCino for industry data automation?

IBISWorld seamlessly integrates with nCino to seamlessly deliver premium industry data. It supports automated workflows, custom dashboards, and dynamic reporting—ensuring teams always have the latest insights at their fingertips.

Can I scale analytics in nCino with IBISWorld’s industry intelligence?

The integration enables scalable analytics by combining IBISWorld’s premium industry intelligence with nCino’s data visualization and reporting tools. As your business grows, you can easily expand data access and analytics capabilities.