IBISWorld Platform

Answer any industry question in minutes with our entire database at your fingertips.

Revenue for the Silver, Lead and Zinc Ore Mining industry remains subdued in 2025-26, having experienced significant volatility in the five years preceding it. Industry revenue has fallen at an annualised 5.2% from 2020-21 to sit at $5.6 billion in 2025-26, when it is anticipated to dip 2.4%. A strong commodity-driven boom occurred through 2022-23, but the recent downtrend in revenue is primarily the result of normalising metal prices, weaker construction activity in China (a key downstream market for zinc miners), and operational headwinds like regulatory delays and declining ore grades at flagship projects like Cannington and Rosebery. The industry’s profit margin has fallen from 20.3% in 2020-21 to 11.3% in 2025-26, a reflection of mounting expenses like purchase costs, legal fees and insurance premiums.

Answer any industry question in minutes with our entire database at your fingertips.

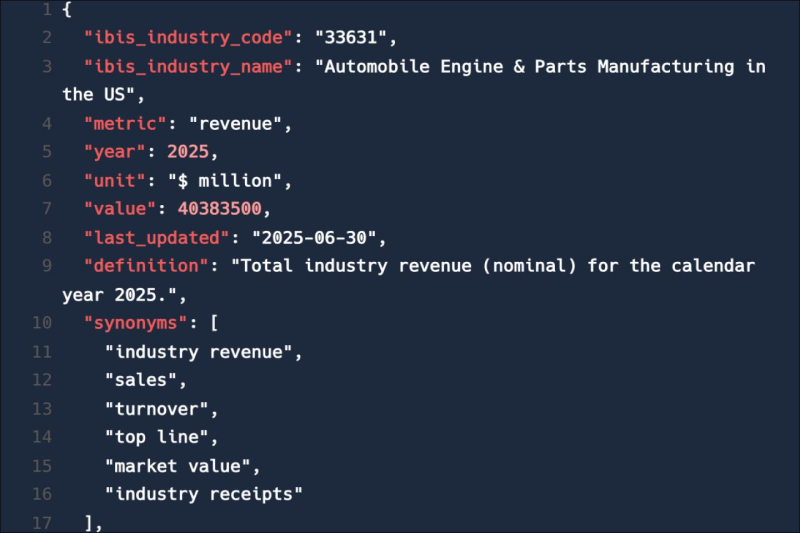

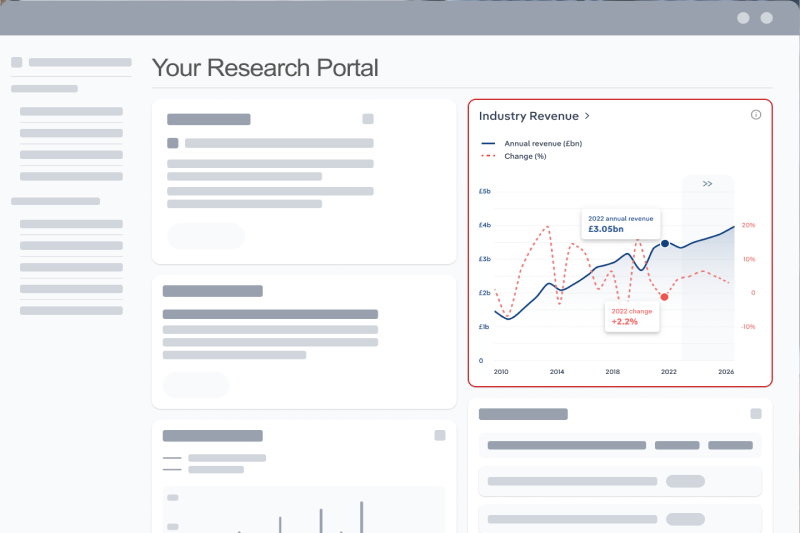

Feed trusted, human-driven industry intelligence straight into your platform.

Streamline your workflow with IBISWorld’s intelligence built into your toolkit.

IBISWorld's research coverage on the Silver, Lead and Zinc Ore Mining industry in Australia includes market sizing, forecasting, data and analysis from 2015-2030. The most recent publication was released October 2025.

The Silver, Lead and Zinc Ore Mining industry in Australia operates under the ANZSIC industry code B0807. Industry firms mainly mine silver, lead or zinc ores. Firms also carry out beneficiation, which involves processing ores into ore concentrate. Related terms covered in the Silver, Lead and Zinc Ore Mining industry in Australia include beneficiation, concentrate and milled grade.

Products and services covered in Silver, Lead and Zinc Ore Mining industry in Australia include Zinc ore and concentrate, Lead ore and concentrate and Silver ore and concentrate.

Companies covered in the Silver, Lead and Zinc Ore Mining industry in Australia include MMG, South32 and Glencore.

The Performance chapter covers detailed analysis, datasets, detailed current performance, sources of volatility and an outlook with forecasts for the Silver, Lead and Zinc Ore Mining industry in Australia.

Questions answered in this chapter include what's driving current industry performance, what influences industry volatility, how do successful businesses overcome volatility, what's driving the industry outlook. This analysis is supported with data and statistics on industry revenues, costs, profits, businesses and employees.

The Products and Markets chapter covers detailed product and service segmentation, analysis of major markets and international trade data for the for the Silver, Lead and Zinc Ore Mining industry in Australia.

Questions answered in this chapter include how are the industry's products and services performing, what are innovations in industry products and services, what products or services do successful businesses offer and what's influencing demand from the industry's markets. This includes data and statistics on industry revenues by product and service segmentation and major markets.

The Geographic Breakdown chapter covers detailed analysis and datasets on regional performance of the Silver, Lead and Zinc Ore Mining industry in Australia.

Questions answered in this chapter include where are industry businesses located and how do businesses use location to their advantage. This includes data and statistics on industry revenues by location.

The Competitive Forces chapter covers the concentration, barriers to entry and supplier and buyer profiles in the Silver, Lead and Zinc Ore Mining industry in Australia. This includes data and statistics on industry market share concentration, barriers to entry, substitute products and buyer & supplier power.

Questions answered in this chapter include what impacts the industry's market share concentration, how do successful businesses handle concentration, what challenges do potential industry entrants face, how can potential entrants overcome barriers to entry, what are substitutes for industry services, how do successful businesses compete with substitutes and what power do buyers and suppliers have over the industry and how do successful businesses manage buyer & supplier power.

The Companies chapter covers Key Takeaways, Market Share and Companies in the Silver, Lead and Zinc Ore Mining industry in Australia. This includes data and analysis on companies operating in the industry that hold a market share greater than 5%.

Questions answered in this chapter include what companies have a meaningful market share and how each company is performing.

The External Environment chapter covers Key Takeaways, External Drivers, Regulation & Policy and Assistance in the Silver, Lead and Zinc Ore Mining industry in Australia. This includes data and statistics on factors impacting industry revenue such as economic indicators, regulation, policy and assistance programs.

Questions answered in this chapter include what demographic and macroeconomic factors impact the industry, what regulations impact the industry, what assistance is available to this industry.

The Financial Benchmarks chapter covers Key Takeaways, Cost Structure, Financial Ratios, Valuation Multiples and Key Ratios in the Silver, Lead and Zinc Ore Mining industry in Australia. This includes financial data and statistics on industry performance including key cost inputs, profitability, key financial ratios and enterprise value multiples.

Questions answered in this chapter include what trends impact industry costs and how financial ratios have changed overtime.

The Industry Data chapter includes 10 years of historical data with 5 years of forecast data covering statistics like revenue, industry value add, establishments, enterprises, employment and wages in the Silver, Lead and Zinc Ore Mining industry in Australia.

More than 6,000 businesses use IBISWorld to shape local and global economies

We were able to supplement our reports with IBISWorld’s information from both a qualitative and quantitative standpoint. All of our reporting now features some level of IBISWorld integration.

IBISWorld delivers the crisp business knowledge we need to drive our business. Whether it be serving up our major clients, winning new business or educating on industry issues, IBISWorld brings real value.

IBISWorld has revolutionised business information — which has proved commercially invaluable to exporters, investors and public policy professionals in Australia and overseas.

When you’re able to speak to clients and be knowledgeable about what they do and the state that they operate in, they’re going to trust you a lot more.

The market size of the Silver, Lead and Zinc Ore Mining industry in Australia is $5.6bn in 2026.

There are 15 businesses in the Silver, Lead and Zinc Ore Mining industry in Australia, which has declined at a CAGR of 3.6 % between 2020 and 2025.

The Silver, Lead and Zinc Ore Mining industry in Australia is likely to be impacted by import tariffs with imports accounting for a moderate share of industry revenue.

The Silver, Lead and Zinc Ore Mining industry in Australia is likely to be significantly impacted by export tariffs with exports accounting for a high share of industry revenue.

The market size of the Silver, Lead and Zinc Ore Mining industry in Australia has been declining at a CAGR of 5.2 % between 2020 and 2025.

Over the next five years, the Silver, Lead and Zinc Ore Mining industry in Australia is expected to grow.

The biggest companies operating in the Silver, Lead and Zinc Ore Mining industry in Australia are MMG, South32 and Glencore

Zinc ore and concentrate and Lead ore and concentrate are part of the Silver, Lead and Zinc Ore Mining industry in Australia.

The company holding the most market share in the Silver, Lead and Zinc Ore Mining industry in Australia is MMG.

The level of competition is low and steady in the Silver, Lead and Zinc Ore Mining industry in Australia.