IBISWorld Platform

Answer any industry question in minutes with our entire database at your fingertips.

The Horse Farming industry has faced challenging trading conditions in recent years as a tempered economic recovery in 2022 reduced individuals' willingness to invest in a horse. High interest rates, reduced household discretionary income and the rising costs of training and care have deterred buyers, with two of the leading auctions, The Inglis Classic Sale and Magic Millions, recording the lowest sales volumes since 2018 for the month of January 2025, and the first decline in syndicate participation in five years. The market has become increasingly reliant on premium stallion sales. While overall transaction volumes have fallen, elite bloodstock continues to command record-breaking prices, with demand heavily concentrated at the top end of the market. This reliance on a small pool of proven sires leaves industry revenue highly exposed to fluctuations in top-tier stallions' availability and performance. Overall, industry revenue is expected to fall at an annualised rate of 3.5% over the past five years to total $1.47 billion in 2025-26, when revenue is anticipated to contract by 0.4%.

Answer any industry question in minutes with our entire database at your fingertips.

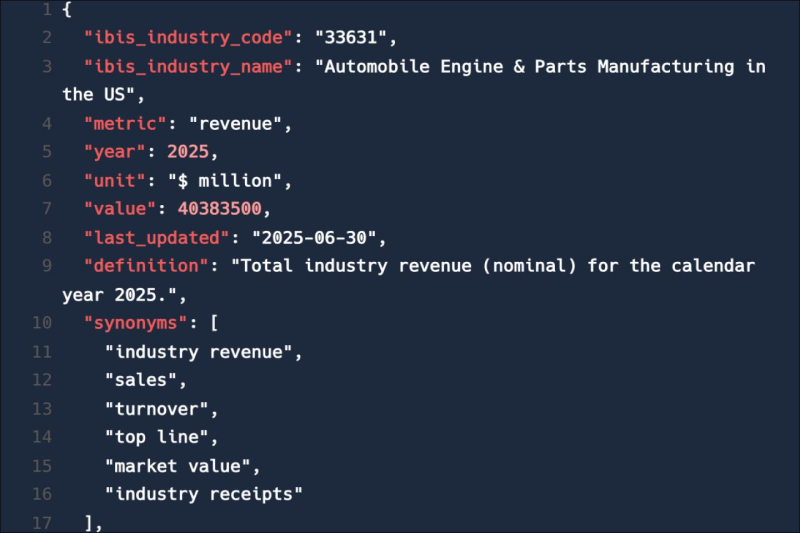

Feed trusted, human-driven industry intelligence straight into your platform.

Streamline your workflow with IBISWorld’s intelligence built into your toolkit.

IBISWorld's research coverage on the Horse Farming industry in Australia includes market sizing, forecasting, data and analysis from 2015-2030. The most recent publication was released November 2025.

The Horse Farming industry in Australia operates under the ANZSIC industry code A0191. The industry engages in horse farming, which includes breeding thoroughbreds, standardbreds and other horse breeds. Thoroughbred and standardbred horses are mainly sold to trainers for the purpose of horse and harness racing, while other breeds are generally sold to the public for recreational purposes. Industry operators also offer agistment services. Related terms covered in the Horse Farming industry in Australia include shuttle stallions, equine influenza, thoroughbred, standardbred, yearling, agistment, broodmare, laminitis and ppe.

Products and services covered in Horse Farming industry in Australia include Thoroughbred services, Thoroughbred sales and Standardbred breeding and services.

The Horse Farming industry in Australia is highly fragmented with no companies holding a market share greater than 5%.

The Performance chapter covers detailed analysis, datasets, detailed current performance, sources of volatility and an outlook with forecasts for the Horse Farming industry in Australia.

Questions answered in this chapter include what's driving current industry performance, what influences industry volatility, how do successful businesses overcome volatility, what's driving the industry outlook. This analysis is supported with data and statistics on industry revenues, costs, profits, businesses and employees.

The Products and Markets chapter covers detailed product and service segmentation, analysis of major markets and international trade data for the for the Horse Farming industry in Australia.

Questions answered in this chapter include how are the industry's products and services performing, what are innovations in industry products and services, what products or services do successful businesses offer and what's influencing demand from the industry's markets. This includes data and statistics on industry revenues by product and service segmentation and major markets.

The Geographic Breakdown chapter covers detailed analysis and datasets on regional performance of the Horse Farming industry in Australia.

Questions answered in this chapter include where are industry businesses located and how do businesses use location to their advantage. This includes data and statistics on industry revenues by location.

The Competitive Forces chapter covers the concentration, barriers to entry and supplier and buyer profiles in the Horse Farming industry in Australia. This includes data and statistics on industry market share concentration, barriers to entry, substitute products and buyer & supplier power.

Questions answered in this chapter include what impacts the industry's market share concentration, how do successful businesses handle concentration, what challenges do potential industry entrants face, how can potential entrants overcome barriers to entry, what are substitutes for industry services, how do successful businesses compete with substitutes and what power do buyers and suppliers have over the industry and how do successful businesses manage buyer & supplier power.

The Companies chapter covers Key Takeaways, Market Share and Companies in the Horse Farming industry in Australia. This includes data and analysis on companies operating in the industry that hold a market share greater than 5%.

Questions answered in this chapter include what companies have a meaningful market share and how each company is performing.

The External Environment chapter covers Key Takeaways, External Drivers, Regulation & Policy and Assistance in the Horse Farming industry in Australia. This includes data and statistics on factors impacting industry revenue such as economic indicators, regulation, policy and assistance programs.

Questions answered in this chapter include what demographic and macroeconomic factors impact the industry, what regulations impact the industry, what assistance is available to this industry.

The Financial Benchmarks chapter covers Key Takeaways, Cost Structure, Financial Ratios, Valuation Multiples and Key Ratios in the Horse Farming industry in Australia. This includes financial data and statistics on industry performance including key cost inputs, profitability, key financial ratios and enterprise value multiples.

Questions answered in this chapter include what trends impact industry costs and how financial ratios have changed overtime.

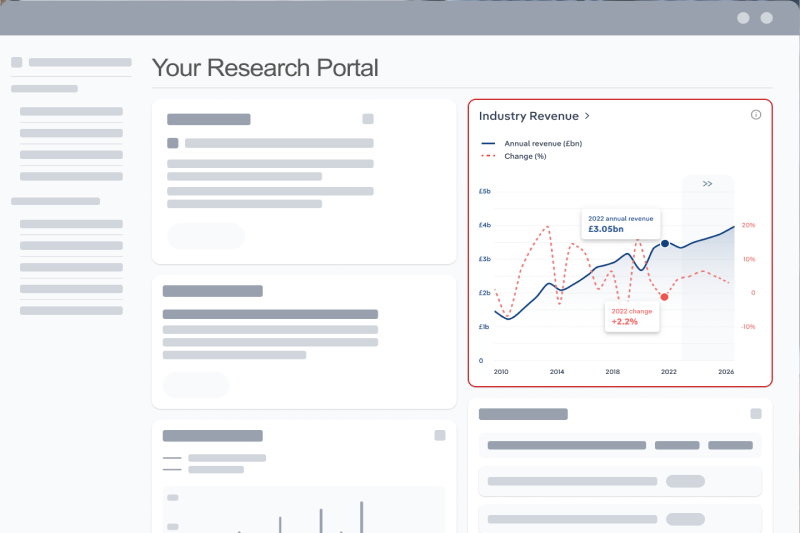

The Industry Data chapter includes 10 years of historical data with 5 years of forecast data covering statistics like revenue, industry value add, establishments, enterprises, employment and wages in the Horse Farming industry in Australia.

More than 6,000 businesses use IBISWorld to shape local and global economies

We were able to supplement our reports with IBISWorld’s information from both a qualitative and quantitative standpoint. All of our reporting now features some level of IBISWorld integration.

IBISWorld delivers the crisp business knowledge we need to drive our business. Whether it be serving up our major clients, winning new business or educating on industry issues, IBISWorld brings real value.

IBISWorld has revolutionised business information — which has proved commercially invaluable to exporters, investors and public policy professionals in Australia and overseas.

When you’re able to speak to clients and be knowledgeable about what they do and the state that they operate in, they’re going to trust you a lot more.

The market size of the Horse Farming industry in Australia is $1.5bn in 2026.

There are 3,204 businesses in the Horse Farming industry in Australia, which has declined at a CAGR of 0.3 % between 2020 and 2025.

The Horse Farming industry in Australia is likely to be impacted by import tariffs with imports accounting for a moderate share of industry revenue.

The Horse Farming industry in Australia is likely to be impacted by export tariffs with exports accounting for a moderate share of industry revenue.

The market size of the Horse Farming industry in Australia has been declining at a CAGR of 3.5 % between 2020 and 2025.

Over the next five years, the Horse Farming industry in Australia is expected to grow.

Thoroughbred services and Thoroughbred sales are part of the Horse Farming industry in Australia.

The level of competition is high and increasing in the Horse Farming industry in Australia.