Trusted by over 6,000 businesses globally

Fast-track evaluations

Answer industry questions faster without compromising accuracy.

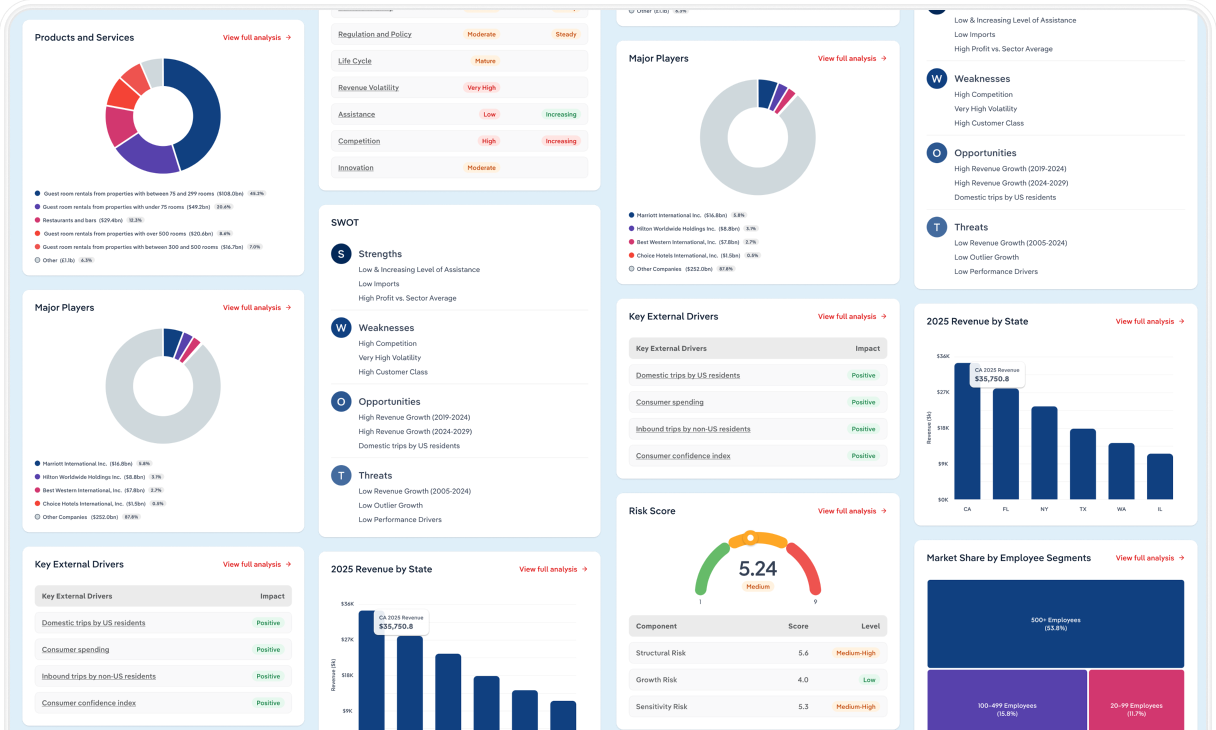

Assess industry viability

Review market size, growth and competitive dynamics to confirm an industry is strong, stable and worth pursuing before you invest.

- Evaluate long-term industry stability without leaving your workflow

- Gauge competitive intensity and barriers to entry to determine whether the industry can support sustainable returns

- Validate investment potential using reliable forecasts and benchmarks that reveal an industry’s trajectory

Discover risks and blind spots

Detect regulatory, competitive and operational threats every time.

- Uncover hidden challenges and prevent surprises from derailing your strategy

- Reveal regulatory pressures, shifting demand drivers and other external risks that could undermine performance

- Use our AI research assistant to instantly surface early warning signals and potential risks

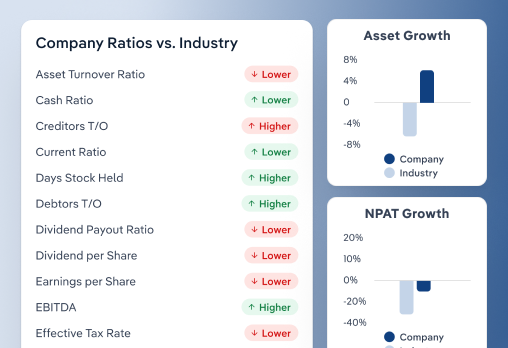

Benchmark and validate assumptions

Compare companies to industry norms and ground strategies in objective intelligence.

- See how your client’s performance, margins and cost structure stack up against industry benchmarks

- Flag unrealistic expectations to strengthen your investment thesis

- Validate financial projections with proprietary five-year forecasts

Catch red flags early

Spot hidden risks right away to save time and protect every decision.

Powering smarter decisions for over 50 years

200+

In-house research analysts

100%

Human-verified intelligence

10m+

Data points

6k+

Clients served

What our clients say

Overall, IBISWorld is an essential tool in my risk assessment process and enhances the quality of service I deliver to our clients.

I highly recommend IBISWorld to any analyst seeking to grow their knowledge base and strengthen their recommendations.

Having easy access to clear, data-backed insights has made it a lot easier to understand the market landscape and tailor our advice more effectively.

IBISWorld’s research empowers our lending and underwriting teams with the clarity and confidence needed to assess industry-specific risks and opportunities.

Our integration partners

Stop switching between tools. Access our data directly in our partner platforms.

Proactively monitor commercial and small business loans across the credit lifecycle.

Coming soon

Bring our structured data into your data ecosystem via the Snowflake Marketplace.

View integration

Improve targeting and make faster connections for small business and middle market lending.

View integrationData verified by analysts, powered by AI

FAQs

Can’t find the answer you’re looking for? Please reach out to our team.

How can IBISWorld support due diligence?

IBISWorld provides industry data and benchmarks to validate decisions, assess risks, and ensure informed investment analysis.

Can IBISWorld identify industry risks for due diligence?

IBISWorld highlights regulatory, operational, and market risks to help businesses avoid potential challenges.

How does IBISWorld improve data-driven decisions?

IBISWorld provides reliable industry intelligence and benchmarking tools to make confident, evidence-based business decisions.