The economy expanded at an annualized rate of 4.3% in Q3 2025, driven by resilient consumer spending that grew despite tariff-inclusive pricing and inflation, demonstrating the economy's initial resilience to the implementation of tariffs. However, underlying dynamics reveal diverging sector performance, with consumer spending strength contrasting sharply against labor market weakness as job creation slowed dramatically compared to the prior quarter. Employers reduced hiring and increased layoffs to restructure operations and control costs, leading to a 4.4% rise in unemployment, which created headwinds for household income growth and future spending sustainability. Inflation remains elevated at 2.8% year-over-year, above the Federal Reserve's 2.0% target, driven primarily by rising electricity and food costs, constraining real wage growth despite nominal wage increases. The Federal Reserve responded to deteriorating labor market conditions by cutting rates 25 basis points in September, easing borrowing costs and supporting mortgage and consumer financing activity. Meanwhile, select nonresidential construction segments, particularly data centers benefiting from investments in artificial intelligence, provided additional growth support during the quarter. This mixed performance—characterized by strong consumption offset by labor weakness and persistent inflation—reflects an economy navigating the impacts of tariffs and policy uncertainty while maintaining modest forward momentum.

Labor

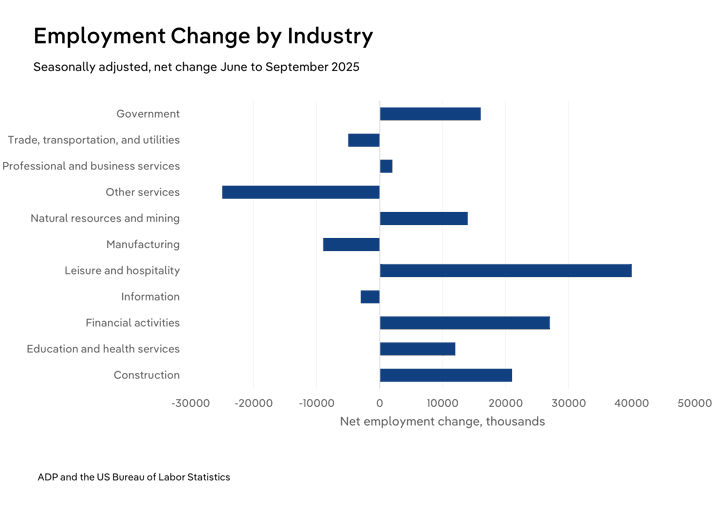

- Private sector employment gains slowed considerably in Q3 2025, adding only 72,000 jobs from June to September—a 0.1% increase. While this represents continued growth, the modest pace signals a tightening labor market with diminishing momentum in job creation.

- Leisure and hospitality and financial activities led job growth during the period. Restaurant expansion and operational scaling drove hiring in the leisure and hospitality sector, with a focus on part-time positions. Financial services firms have added positions to replace retiring workers and build internal engineering capabilities, particularly in cybersecurity and cryptocurrency services, where demand for skills has intensified.

- The unemployment rate rose to 4.4% by September from 4.1% at the start of Q3, marking the worst level since October 2021. Rising costs, tariff-related uncertainty and weakening business growth outlooks prompted companies to restructure and reduce headcount. The manufacturing, logistics and information technology sectors experienced significant job losses during this period.

- Wage growth moderated significantly despite ongoing expansion. Year-over-year wage growth reached 2.0% in September, down sharply from 5.4% in June, as companies tempered compensation increases to manage inflationary pressures and uncertainties in costs. This deceleration reflects business caution amid economic headwinds, with a focus on cost control over aggressive wage expansion.

Consumer Spending

- Real personal consumption expenditures (PCE) increased 0.7% in the quarter from the previous quarter as consumers adjusted to tariff-inclusive pricing. This modest growth reflects a market grappling with elevated price levels that have constrained discretionary purchasing and shifted spending priorities.

- Durable goods spending grew 0.3% in real terms, driven primarily by software and applications. The rising adoption of artificial intelligence has driven spending on subscription-based premium features, which consumers favor because of their value proposition amid price pressures. Motor vehicle spending declined substantially as escalating prices weakened buyer demand and affordability.

- Nondurable goods spending rose 0.9%, supported by essential categories such as food, gasoline and medicine, areas in which consumers maintained necessary replenishment despite price increases. However, consumers curtailed spending on items experiencing significant tariff-driven price increases, such as beef and coffee, as these purchases could be reduced or substituted.

- Service spending ticked up by 0.7%, reflecting stable demand amid two offsetting trends. Consumer spending on financial services increased as households worked with investment advisors to manage wealth and supplement income. Recreational services, including amusement parks, campgrounds and shorter domestic trips, gained traction as consumers substituted domestic leisure for costly international travel.

Inflation

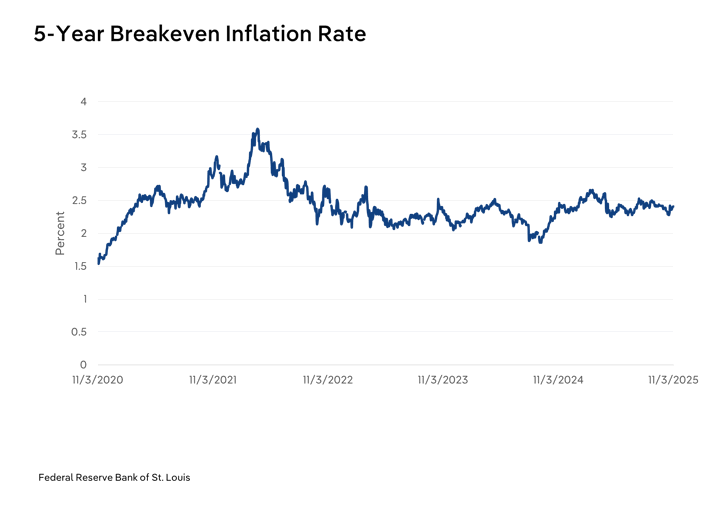

- Year-over-year inflation rose to 2.8% in Q3 2025, up 0.7% from the prior quarter, primarily driven by the implementation of tariffs and ongoing supply chain constraints. Inflation remains above the Federal Reserve's 2.0% target, pressured by government import duties that have raised prices across broad categories.

- Energy services inflation led major categories at 6.0% annualized growth in September 2025. Surging electricity demand from expanding data center construction and increased artificial intelligence usage strained grid capacity, pushing electricity prices up 5.6% year-over-year in Q3. Conversely, gasoline prices fell 0.4% year-over-year as hikes in OPEC production eased global oil supply constraints, lowering US fuel costs.

- Food inflation accelerated to 3.1% year-over-year in September 2025, driven by multiple supply pressures. Domestic beef production declined because of persistent droughts that reduced cattle herds, while adverse weather in Brazil and Colombia—key beef and agricultural suppliers—further tightened global supplies. Past tariffs on South American imports compounded cost pressures. Despite price increases, food continues to maintain strong consumer demand, sustaining upward pricing pressure throughout the third quarter.

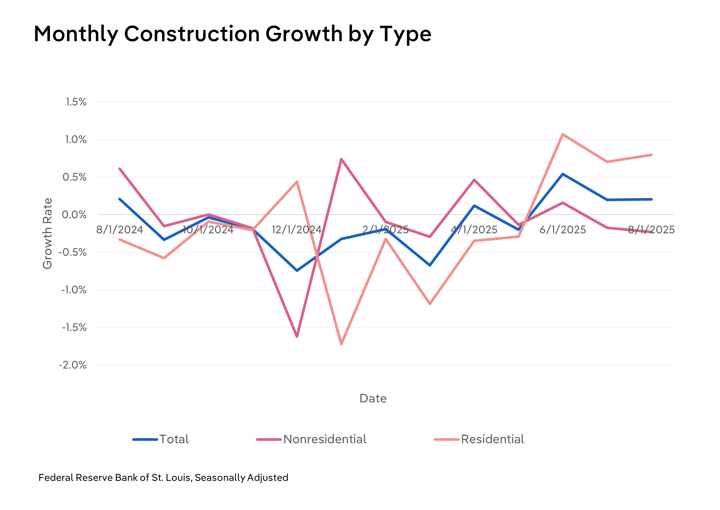

Residential construction

- Residential construction investments grew 1.7% quarter-over-quarter in Q3 2025, driven by accelerating multifamily residential starts over single-family construction. This shift reflects persistent housing supply constraints and affordability pressures that have made multifamily development the preferred type of development. Population density increases and rising home prices continue to support multifamily valuations, particularly for price-sensitive consumers unable to purchase single-family homes. Momentum in multifamily construction shows no signs of slowing as these dynamics persist.

- Existing home prices reached $412,300 in September 2025, up from $407,600 in 2024, but declining from the Q3 starting point. Expanding inventory, driven by increased home listings and declining mortgage rates, supported growth in existing home sales throughout the quarter. September sales increased from August levels, reflecting buyer response to rate reductions and improved affordability conditions.

- New home sales surged 20.5% month-over-month in August 2025, marking the most substantial monthly hike in years. Declining mortgage rates and forward expectations of additional Federal Reserve rate cuts prompted early purchases. Notably, a significant portion of August sales included homes still under construction, indicating that buyers had locked in financing ahead of anticipated rate cuts, which accelerated closings despite ongoing construction timelines.

Nonresidential construction

- Nonresidential construction investments declined 0.2% from Q2 to Q3 2025, primarily because of sharp pullbacks in manufacturing construction. Manufacturing spending fell 2.0% following substantial reductions in IRA and CHIPS Act federal funding allocations, which constrained overall nonresidential growth.

- Commercial office construction also softened as tenant demand weakened. Declining absorption rates over the past two quarters reduced expansion project interest, with developers increasingly converting underutilized office space to residential or flexible hybrid formats rather than pursuing massive new construction.

- Data centers emerged as a bright spot, with spending remaining elevated on a quarter-over-quarter basis. Robust private sector investment in artificial intelligence, combined with long-term infrastructure commitments from major technology companies like OpenAI, is driving demand. The Trump administration accelerated permitting timelines, streamlined environmental reviews and offered federal loan guarantees and land access for qualifying projects, further bolstering data center construction investment growth.

Financial

- The Federal Reserve cut interest rates by 25 basis points in September 2025, marking the first reduction after holding rates steady through five consecutive meetings. Federal Reserve Chair Jerome Powell attributed the cut to deteriorating labor market conditions, citing insufficient job growth and private sector hiring. The rate cut signaled policy support to encourage employment expansion and prevent economic deterioration.

- Equity markets surged on this accommodative shift. The S&P 500 gained 8.0% in Q3 and 16.0% year-to-date, with mega-cap technology stocks—namely NVIDIA and Meta—driving the majority of gains. Investor enthusiasm for artificial intelligence as a productivity solution and business enabler fueled this outperformance, reflecting confidence in tech-driven growth trajectories.

- However, portfolio positioning reveals underlying caution. Investors simultaneously increased their allocations to safe-haven assets, with precious metals, including gold and silver, rallying in tandem with equities. This divergent positioning suggests investors are hedging against potential trade policy shifts and economic headwinds while maintaining exposure to growth opportunities. The concurrent strength in both risk assets and defensive holdings reflects a market balancing optimism about technology and AI with uncertainty about the economy's trajectory.

Risk ratings

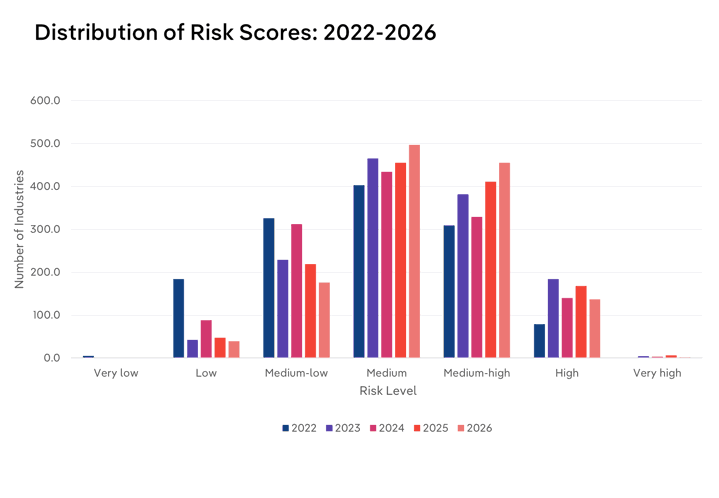

- Inflation and supply chain disruptions dominated market conditions in 2022. These pressures exposed vulnerabilities across sectors, with 29.7% of industries rated as medium-high risk or higher.

- Aggressive interest rate increases compounded economic uncertainty in 2023. Central banks tightened policy to combat persistent inflation, pushing 43.6% of industries into the medium-high risk category or above.

- Inflation and interest rates both moderated in 2024, with rate cuts beginning in September. Despite this easing, year-over-year price growth remained at 2.9%—above the Federal Reserve's 2.0% target. This sustained inflation limited the relief for businesses and consumers, keeping 36.1% of industries at medium-high risk or higher.

- The implementation of tariffs created new economic headwinds in 2025. While selective trade pauses and negotiated deals offered partial mitigation, uncertainty persisted around rising input costs and weakening trade growth. Consumer demand has become increasingly price-sensitive, constraining operators' ability to pass tariff-driven cost increases to customers without risking volume losses. This pricing pressure and reduced consumer spending appetite elevated risk exposure, with 44.8% of industries classified as medium-high risk or higher.

Sector rankings

- Agriculture, Forestry, Fishing and Hunting: Persistent droughts and sluggish cattle growth have long burdened this sector. Export challenges have compounded these pressures—China's retaliatory tariffs on soybeans and other US agricultural exports continue to erode global demand. Fertilizer costs remain elevated because of persistent supply constraints. Although the US has begun easing tariffs on fertilizers and acquiring Belarusian potash following the December 2025 sanctions relief, these efforts will provide limited relief. China's export controls on phosphorous fertilizers, introduced before 2025 and set to intensify through August 2026 amid aggressive lobbying from domestic trade associations seeking to protect domestic producers, represent the primary obstacle to cost reduction. The loss of this major supplier will force US farmers to rely more heavily on imports, widening the cost gap. Beyond input expenses, environmental hazards pose ongoing threats. Droughts and screwworm infestations—flesh-eating parasites that devastate cattle herds—create significant vulnerabilities in the supply chain. These challenges will pressure the Soybean Farming and Beef Cattle Production industries.

- Mining: This sector faces divergent outcomes across subsegments. Expanded domestic energy production creates opportunities for some players, yet global competition remains fierce. OPEC+ production increases and sustained Asian purchases of Russian oil limit growth for US energy exports. Demand erosion in key markets, such as Asia, poses a threat to the recovery prospects of domestic producers. Coal mining faces structural headwinds as nations accelerate their adoption of renewable energy, narrowing its market scope to niche applications and transitional uses. The shift away from coal in favor of renewables will accelerate the contraction of the industry. This outlook pressures the Coal Mining and Oil Drilling & Gas Extraction industries.

-

Construction: Mixed market conditions characterize this sector. Rising construction material costs, driven by tariffs and supply chain constraints, pose significant challenges. However, nonresidential construction benefits from robust investment in data centers, backed by public and private sector support. Residential construction shows diverging patterns. Single-family home construction faces headwinds, while multifamily residential construction continues to gain momentum. State-led affordability initiatives directing capital to multifamily projects create strong opportunities for residential builders and commercial construction operators in select markets over the coming years. These dynamics position the Housing Developers and Commercial Building Construction industries favorably for growth.