Key Takeaways

- Labor-efficient sectors are scaling revenue without proportional headcount growth, offering a strategic edge in today’s constrained hiring environment.

- Sectors that maintain stable wage-to-revenue ratios and rising revenue per worker are best positioned to convert demand into delivery without execution drag.

- For strategy teams facing tight budgets and operational limits, labor efficiency is a critical filter for identifying scalable, defensible growth opportunities.

For years, strategic growth playbooks have revolved around demand. Is the market expanding? Are customers spending? Are tailwinds strong? But today, those questions are only half the picture. In a world constrained by labor shortages, wage inflation, and slower hiring, capacity to deliver is emerging as a new axis of competitive advantage.

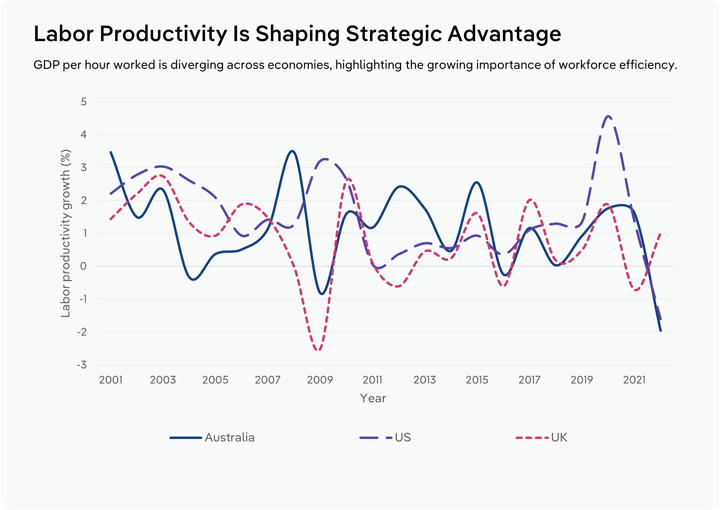

Across the US, UK, and Australia, businesses are encountering a stubborn disconnect: topline opportunity is rising, but workforce scalability isn’t keeping pace. In the UK, over 2.8 million people are economically inactive, while vacancy durations in technical and public-facing roles have stretched far beyond pre-pandemic norms. In Australia, even as profitability has improved, employment growth has lagged, and productivity per worker has barely budged.

Yet some sectors are quietly pulling ahead. These industries aren’t just growing; they’re scaling smart, absorbing wage growth while maintaining or even improving revenue per worker. They’re optimizing workflows, leveraging automation where it fits, and reducing their dependency on unpredictable labor inputs. In short, they’re showing labor efficiency that’s not only operationally valuable but strategically underappreciated.

For strategy teams navigating capacity constraints and resource friction, this shift reframes where the real opportunity lies. The most compelling sectors in today’s market aren’t necessarily the ones with the most demand, but the ones that can convert demand into output without overextending their teams. Identifying these lean-growth performers early can sharpen expansion bets, validate resource requests, and build confidence with even the most skeptical executive team.

Lean-growth champions: Which sectors stand out?

Not all industries are feeling the labor crunch the same way. While some remain trapped in a cycle of stalled hiring and rising costs, others are showing surprising resilience, delivering strong output with stable or shrinking teams.

For strategy teams aiming to isolate these “lean-growth” performers, sector-level data was examined through three core signals of labor efficiency:

- Rising revenue per worker despite wage pressure.

- Flat or falling headcount alongside margin gains.

- Wage-to-revenue ratios that have stayed stable or improved since 2022.

What emerged is a short list of globally consistent standouts. These are sectors where delivery doesn’t rely on constant labor expansion, where process design and pricing power allow companies to absorb rising costs, and where growth is still possible even when hiring stalls.

Professional and technical services

Professional and technical services, including engineering, software consulting, legal tech, and R&D, has emerged as a standout for labor efficiency. Even as wage pressures mount, these firms are growing revenue without ballooning headcount. In the US, leading firms like McKinsey and Boston Consulting Group report over $350,000 in revenue per employee, while the broader industry has seen revenue-per-worker gains of 7.2% year-over-year entering 2025.

In the UK, private-sector wages rose more than 8% between 2019 and 2023, yet the sector’s labor share of output remained flat, suggesting strong productivity gains and pricing resilience. Australian firms in engineering and technical consulting show similar patterns. Despite higher wages, profitability has held steady as operators use modular workflows and digital tooling to deliver more value per employee.

What distinguishes this sector isn’t just the ability to raise rates; it’s how firms have embedded efficiency into their delivery models. Many are automating routine tasks, streamlining project delivery, and investing in digital platforms that enable teams to scale without the traditional hiring drag. This has helped stabilize wage-to-revenue ratios and protect margins even as talent markets tighten.

In a growth environment defined by execution constraints, these firms are showing that it’s possible to expand without overextending. Their ability to absorb wage growth while increasing revenue per worker makes them one of the clearest examples of lean, scalable strategy in action.

Payment systems and fintech

Payment systems and fintech players are emerging as standout low‑labor growth models, offering scalability that doesn’t depend on hiring.

In the UK, the payment systems industry is growing at a 5‑year CAGR of 6.6%, with revenue projected to reach approximately £9.7 billion by 2024–25. Notably, total wage costs in the sector have actually declined by about 9% over five years through 2024, despite rising volumes and digital adoption. This indicates the sector is managing expanding throughput via automation and platform-based scaling rather than staff growth.

In Australia, fintech sectors continue to mature, with 88% of firms post‑revenue and 43% already profitable in 2023, up from 30% the prior year. While comprehensive labor‑cost statistics are rare in public sources, surveys suggest firms are optimizing resource use, helping them increase revenue per employee despite rising sector maturity.

In the US, digital finance operators are benefiting from the fintech boom, producing nearly twice as much revenue per employee as traditional financial institutions—a productivity gap powered by digital-first delivery, not headcount scaling.

Together, this data suggests that payment systems and fintech firms are not only expanding rapidly, but doing so with lean teams. Revenue scales with transaction volume, helping these sectors absorb wage inflation while keeping labor costs flat or declining relative to revenue. It’s a model well suited for strategic planners looking to tap resilient, delivery-efficient growth opportunities in financially constrained markets.

Specialized machinery & equipment manufacturing

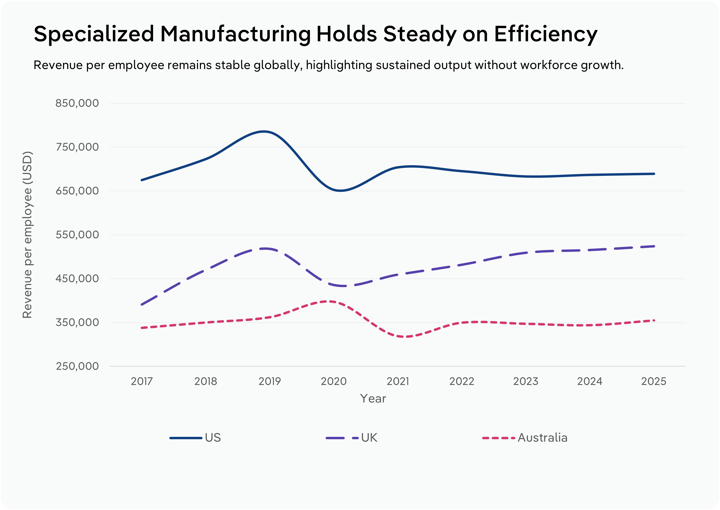

The specialized machinery and equipment manufacturing sector, particularly producers of mining, construction, or industrial machinery, stands out across major markets for capturing productivity growth even as workforce expansion stalls. In the US, overall manufacturing output rose by roughly 1.2% in 2023, while employment climbed just 0.1%, pointing to increasing output per worker and subdued labor demand in precision-focused sub-segments. Hours worked have declined in over half of detailed machinery manufacturing categories between 2019 and 2024, despite steady or rising production, suggesting greater efficiency per labor hour.

In Australia, employment in industrial machinery manufacturing grew at only 0.6% per year between 2019 and 2024, with a plateau or slight decline into 2025, even as revenue continued to grow. Firms in this sector have been able to produce more with the same or fewer employees by investing in automation, equipment standardization, and modular production lines, particularly in export-driven segments like mining technology.

Wages have crept upwards modestly, but productivity gains have helped absorb that pressure. Capital-intensive operations and skilled worker retention strategies allow firms to maintain margin integrity. In export-heavy niches such as industrial fans, drilling equipment, and automated processing systems, manufacturers are converting upwardly scalable demand into higher revenue per worker, rather than search-dependent labor growth.

When viewed through a strategy lens, this sector illustrates a compelling bounded-growth model: it scales revenue per hire and tolerates wage inflation through engineered efficiency. For strategic planners weighing sectors that can expand without pushing headcount, specialized machinery manufacturing offers a powerful case of output-driven performance in tight labor conditions.

Why labor‑efficient sectors matter more than ever

Today’s strategy environment demands more than topline demand; it requires scalable delivery. Labor shortages and rising wages force companies to confront the cost of execution rather than just pipeline forecasts. Even well-funded projects can stall when teams can’t grow fast enough. Yet sectors that prioritize labor efficiency get ahead of this friction: they scale without needing to scale their headcount.

For example, one analysis predicts that labor will be the largest cost increase for most companies in 2024 and 2025, underscoring the urgent need for productivity improvements to offset rising expenses. In Australia, surveys of mid‑market leaders found that cost and margin pressures, including the cost of staying competitive amid wage inflation, are top concerns for 80 percent of respondents, even as most still forecast positive growth.

These labor‑efficient sectors, such as professional services, fintech, and machinery manufacturing, don’t just grow demand; they convert demand into revenue using fewer new hires. That creates strategic resilience. Execution capacity becomes more predictable, margins stay intact, and teams can make the case: “We can scale without hiring more people.” This is especially powerful for strategic planners working under budget constraints or facing executive resistance to headcount increases.

As boards grow more cautious and resource requests meet higher scrutiny, sectors with strong revenue-per-employee metrics, flat or declining FTE growth, and stable wage-to-revenue ratios offer concrete proof points. In this context, being able to say you’re growing through efficiency, not additional hiring, isn’t just an operational advantage; it’s a strategic differentiator.

Strategy toolkit: How to prioritize labor-efficient sectors

For strategy managers trying to grow smart, labor efficiency offers a clearer benchmark for scalable opportunity. But it’s not enough to know which sectors are lean. You need to translate that knowledge into planning actions that de-risk execution and secure buy-in from cautious decision-makers.

Start with revenue per employee

Use this as a baseline signal for execution scalability. If a sector consistently generates above-average revenue per worker, even during periods of wage pressure, it’s a strong candidate for resource-light expansion.

Compare wage-to-revenue ratios over time

Look for sectors where wage costs have held steady or declined as a share of revenue since 2022. That’s a sign of operational discipline and resilience. These industries tend to have pricing power, automation maturity, or service models that absorb labor pressure without margin erosion, making them safer bets in inflation-prone environments.

Stress-test with hiring assumptions

When building models or presenting options, ask: How many people does this strategy actually require? Could persistent vacancies delay execution? If your expansion plan relies heavily on ramping up hiring in tight labor markets, you're exposing the business to avoidable delivery risk. Labor-efficient sectors keep this variable under control.

Use labor efficiency to secure buy-in

If you’re juggling hesitant CFOs or resource-constrained delivery teams, labor metrics can shift the conversation. Demonstrate that your strategy is doable. That you’re not only forecasting demand, but anticipating how to fulfill it without straining existing capacity. Framing opportunity in terms of labor efficiency can move undecided stakeholders toward action.

Reframe where opportunity lives

Some of the most strategically valuable sectors aren’t the fastest-growing; they’re the most scalable. In today’s labor market, that means sectors that stretch existing teams further, not those that demand aggressive headcount growth. For teams facing margin pressure and execution drag, these lean-growth industries are often the most underutilized plays in the portfolio.

Final Word

With rising wages and slow hiring, growth is not just about spotting opportunity. It is about converting it efficiently. Labor is no longer a background cost. It is a constraint on execution, and business strategists who ignore it risk building plans their teams cannot deliver.

The sectors profiled in this article stand out for their ability to scale output without expanding headcount. These industries are absorbing wage pressure, protecting margins, and maintaining productivity through smarter workflows and operating models.

For business strategists, labor efficiency is becoming a critical filter in planning. It sharpens execution forecasts, flags operational risk early, and helps secure buy-in from stakeholders who are cautious about overstretching teams. It also reframes what viable growth looks like. Not just fast, but deliverable.

Labor efficiency is not just about doing more with less. It is about targeting sectors where growth can happen without friction. In a high-cost, resource-constrained environment, that makes it one of the most important inputs in strategic planning.