Key Takeaways

- Strong market demand does not guarantee success when labor shortages, slow hiring, and productivity stalls limit execution.

- High-growth sectors like logistics, aged care, and cybersecurity face structural workforce constraints that put delivery at risk.

- Strategy teams must integrate labor data into forecasting to ensure growth plans are both ambitious and realistically executable.

Business strategists today face a new reality: strong market demand no longer guarantees scalable growth unless operational capacity can keep up. In 2023, US GDP was 0.5 to 1.5% age points lower because employers couldn’t fill excess job vacancies, highlighting how unmet demand translates into lost economic output.

Across key sectors, from healthcare to manufacturing, growth ambitions are bumping up against labor constraints. In the U.S. manufacturing industry, more than 400,000 skilled roles remain unfilled, slowing production and delaying expansion plans, even as nearshoring and government stimulus drive volume higher. In civil engineering roles across the UK, skills‑shortage vacancies jumped 84% between 2022 and 2024, even as total hard‑to‑fill roles elsewhere fell, underlining how specific growth segments are choking on talent gaps.

What begins as promising revenue forecasts can stall when hiring, onboarding, and retention struggles intersect with execution plans. From automation tech workflows to training pipelines, the true risk lies in underestimating time-to-capacity. In several sectors, demand is rising, but workforce infrastructure is failing to catch up.

The concept of the growth gap highlights a critical misalignment: sectors where demand is strong but delivery capacity remains fundamentally constrained. To avoid costly misfires, business strategists must go beyond topline forecasts and evaluate whether the workforce can realistically support expansion. Factoring in vacancy rates, productivity limits, and onboarding timelines helps surface execution risks early, before they derail strategy. Identifying sectors vulnerable to labor bottlenecks enables more grounded, defensible planning and ensures growth objectives remain deliverable, not just aspirational.

Where growth meets a wall: Spotting the demand-capacity disconnect

A recent survey of over 320 Australian C‑suite business leaders found that 39% identified cost control amid inflation pressure as a top barrier to growth, while 48% ranked future skills gaps as a key long-term risk. This disconnect defines the growth gap: when topline projections rise faster than the workforce can scale. What looks like opportunity on paper often breaks down in practice due to persistent hiring backlogs, productivity stalls, or underdeveloped training pipelines.

Long vacancy durations

Across the world, critical roles are going unfilled for longer. The UK recorded 818,000 job vacancies in early 2025, despite overall declines from prior peaks. In the US, job openings remained high at 7.4 million as of June 2025. U.S. employers now average 35 days to fill a role, a figure that climbs in healthcare, logistics, and manufacturing. These stretched timelines delay delivery, even when demand is robust.

Stagnant productivity

When hiring slows, productivity must pick up the slack, but that’s no longer happening. In Australia, multifactor productivity grew just 0.1% in 2023, and long-run trends have weakened to 1.2% per year, down from over 1.5% a decade ago. As output per hour flattens, capacity becomes increasingly constrained by headcount.

Retention and training lags

Training and onboarding woes deepen execution risk for many companies as well. In the UK, employer training investment dropped by over £6 billion between 2022 and 2024, with training spend per employee falling nearly 30% since 2011. Australia has also experienced a 14% decline in participation in work-related training since 2007. Together, underinvestment in training and slow onboarding cycles mean new hires take longer to contribute, and attrition risks rise before ramp-up completes.

These factors, vacancy backlogs, stagnant productivity, underfunded training, and onboarding delays, are at the heart of the growth gap. Strong demand may be present, but without scaling delivery capability, forecasts become aspirational rather than actionable. Trusted strategy teams need to embed these labor realities into their planning models to ensure growth is deliverable, not just anticipated.

When demand outpaces delivery: Sectors at risk

Some industries are signaling strong demand—rising revenue, growing pipelines, or policy-driven momentum. But that growth isn’t always deliverable. Labor constraints like stalled hiring, long vacancies, and flat productivity are starting to limit how fast sectors can scale.

Certain industries in key regions face a widening gap between what the market demands and what their workforces can realistically support. For strategists, this means rethinking how growth is planned and executed.

The following watchlist highlights sectors where opportunity is high but execution is at risk. Each shows a mismatch between revenue outlook and labor capacity, raising red flags for teams building forecasts, seeking approval, or structuring entry into new verticals.

Warehousing and logistics

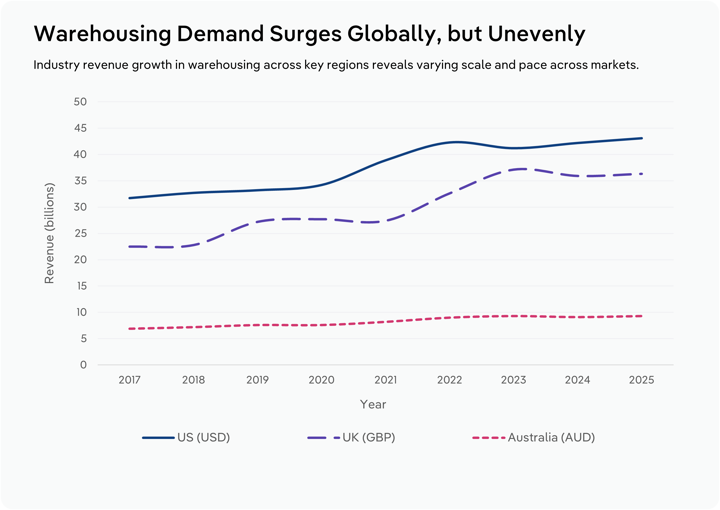

Demand for warehousing and logistics continues to accelerate across the United States, the United Kingdom, and Australia. The UK warehousing and storage industry expanded at a 5.6% CAGR from 2020 to 2025, reaching an estimated £36.3 billion in revenue by mid‑2025. In the U.S., general warehousing and storage grew at about 2.6% CAGR from 2019 to 2024, rising to approximately US $43.1 billion in 2025. Australia’s general warehousing and cold storage market is projected to grow at roughly 1.9% in 2025, continuing demand albeit at a more modest clip.

Yet despite booming demand, delivery capacity is under strain. In the UK, 86% of logistics organisations surveyed reported ongoing warehouse operative shortages, and 13% described the shortage as severe, with driver shortages adding further pressure. Other surveys found 76% of supply‑chain leaders across Europe and North America face notable workforce shortages, with 37% at high or extreme levels, directly impacting service levels in warehouse and transportation operations.

Automation has yet to fully close the gap. Many operators—particularly smaller third-party logistics companies—lack capital for large-scale robotics or inventory‑automation systems, meaning throughput still depends on headcount. As labor pipelines remain tight and hiring lead times stretch, productivity gains stall even with rising demand.

For strategists, warehousing and logistics illustrate a clear growth gap: compelling top-line growth, but execution capacity capped by workforce limitations. Operational planning must account for vacancy backlogs, find realistic headcount ramp paths, and weigh automation timing carefully. Forecasts built on demand alone risk under-delivery unless tied to workforce feasibility and on‑ground scaling realities.

Aged care & healthcare services

Growing demand in aged care and healthcare is driven by rapidly aging populations in both Australia and the UK. Australia’s over-65 population is poised to comprise a much larger share of total demographics over the coming decades, and in the UK the over-85 cohort is projected to double by mid-century, supporting growth forecasts above 3% per year for aged and residential care services.

Yet delivery capacity is constrained. Australia faces a projected shortfall of at least 110,000 direct care workers by 2030, unless workforce supply significantly increases. Similarly, reluctance to train new staff and retention challenges have kept productivity flat since 2015, limiting capacity to deliver care at scale, regardless of demand.

In the UK, service strain is manifesting in bed availability and staffing limits. Only 86 net new care home beds were added nationally in 2024, despite a growing elderly population and aging-related demand surges; a net capacity rise of less than 1%, even as demand rises sharply. Care home vacancies remain elevated, and delays in discharging returning elderly hospital patients due to lack of care placements signal clear delivery pressure.

Even as government mandates raise minimum staffing minutes per resident, retention and training pipelines are not aligning. Regulatory reforms requiring higher care-minute thresholds increase staffing demand, but onboarding remains slow and attrition high across both countries. Automation or tech-driven efficiency gains are minimal in this labor-intensive sector.

This combination of strong demographic tailwinds paired with structural workforce constraints forms a sharp growth gap. Aged care looks like an opportunity-rich sector, but execution hinges on scalable caregiver availability. Business strategists targeting expansion must build in realistic ramp-up curves, account for time-to-fill care roles, and stress-test delivery scenarios, not just market demand models.

Cybersecurity & AI‑driven software

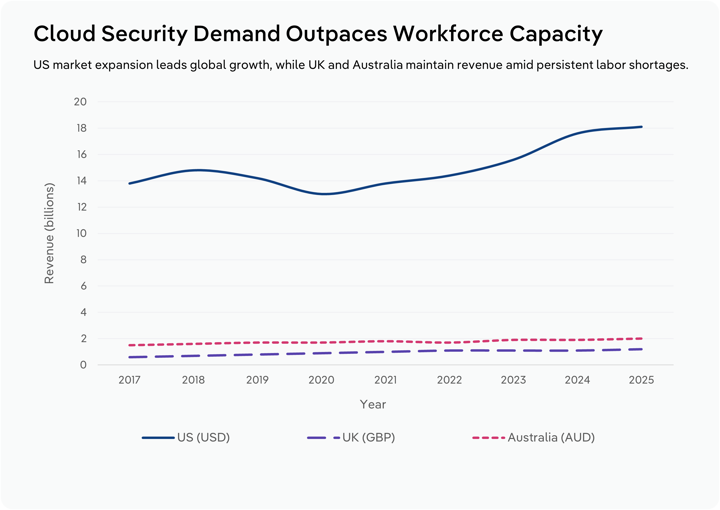

Cybersecurity and AI-enabled software markets are scaling rapidly, propelled by escalating enterprise demand, regulatory pressure, and increasingly sophisticated cyber threats. In the UK, the cyber security software development industry has grown at an annualized 5.6% over the past five years, reaching £1.1 billion by 2024. In the US, the cloud security software market has expanded at a 6.7% annual growth rate, hitting $17.2 billion in 2024. These numbers reflect an enterprise shift toward zero-trust frameworks, cloud-native defenses, and AI-led threat detection.

But delivery capacity is struggling to keep pace. Global cybersecurity faces a shortfall of 4.8 million professionals, with many roles in cloud architecture, AI security, and identity governance going unfilled. In the UK, vacancy data suggests approximately 17,000 open roles in cybersecurity, and the government reports that half of all UK businesses lack advanced incident response capabilities.

Hiring timelines are now materially affecting implementation schedules. In the US, enterprise tech leaders report that security rollouts tied to AI initiatives are increasingly delayed by multi-month recruitment cycles and high attrition, especially in high-pressure security operations teams.

The lesson for business strategists is not just to anticipate labor friction, but to rethink pacing models entirely. In fast-moving technology markets like cybersecurity and AI, workforce constraints don’t just delay execution. They can erode competitive positioning. When speed-to-scale defines advantage, labor bottlenecks aren't just a risk to delivery; they're a risk to relevance.

Strategic filters for a labor-constrained growth environment

Strong demand signals are no longer enough to justify a growth move. In labor-constrained environments, strategy must account for how and whether delivery can keep up. Business strategists who fail to integrate workforce feasibility into planning risk building targets that look good in a slide deck but collapse in execution. The following playbook reframes how to evaluate opportunity, secure resourcing, and de-risk growth.

1. Forecast capacity alongside demand

Many teams stop at top-line indicators: revenue projections, market CAGR, or policy tailwinds. But real delivery hinges on the workforce. Strategists should layer in metrics like vacancy duration, average time to productivity for new hires, and attrition rates when sizing opportunities. A sector growing at 5% CAGR may still underdeliver if median roles take three months to fill and turnover spikes in year two. Treat workforce lag as a core planning constraint, not an operational afterthought.

2. Benchmark labor productivity, not just revenue growth

Output per worker is a leading indicator of execution scalability. When revenue is rising but labor productivity is flat or falling, that’s a red flag. It signals that additional output is coming from headcount expansion, which may not be sustainable. Industry data on revenue per employee, wage share of output, or hours worked per unit produced can help identify where labor is enabling growth versus where it’s holding it back.

3. Flag “labor overhangs” early in strategy conversations

Execution roadblocks are easier to solve before plans are set. Strategists should identify sectors with persistent labor friction early in the planning cycle. This helps avoid sunk time on scenarios that can’t scale, and focuses attention on workarounds, like automation, outsourcing, or phased rollouts, before budgets and stakeholder expectations harden. Labor bottlenecks are not just HR’s problem; they shape the pace, scale, and sequencing of business strategy.

4. Use data to win resource debates

Labor shortfalls are ROI risks. When strategists bring credible data on workforce constraints, they shift resourcing conversations from speculative to evidential. Whether making the case for automation investment, outsourcing partnerships, or upfront headcount, grounding requests in labor feasibility strengthens cross-functional alignment and speeds up executive buy-in.

In constrained environments, strategy is no longer just about spotting opportunity. It’s about proving it can be delivered. Planners who embed labor realities into growth models sharpen their forecasts, reduce execution drag, and earn the trust of decision-makers who can’t afford delays.

Final Word

Not all growth is created equal. Today, strong demand alone is no longer enough to justify expansion. Business strategists must look beneath the topline to understand whether the workforce can realistically deliver what the market is asking for. The most overlooked risks are often operational: roles that go unfilled, new hires that take months to onboard, or productivity that plateaus even as demand climbs.

The sectors flagged in this article—warehousing, aged care, cybersecurity—are not lacking opportunity. What they lack is scalable delivery capacity. That disconnect between ambition and execution is where strategy often breaks down.

To avoid missteps, planning teams need to embed labor data directly into their models. Execution feasibility must become a default lens in sector prioritization, resource requests, and market entry strategy. Doing so not only reduces costly delays but also strengthens credibility with stakeholders.

Growth that cannot be delivered is not growth. Strategists who recognize this early will be the ones who do not just predict the future but build it.