Key Takeaways

- Cross-selling can deepen client relationships, but unchecked expansion in hot sectors risks portfolio overexposure.

- Industry benchmarks and early warning signals help underwriters separate sustainable growth from short-term borrower leverage.

- Targeted cross-sell works best when paired with stress tests that protect credit quality while capturing new demand.

Banks are facing mounting pressure to expand revenue while safeguarding credit quality. Traditional relationship-based selling, once the backbone of commercial banking, is no longer enough on its own. Clients now expect industry-specific insights and tailored solutions that go beyond transaction-based services. For credit teams, this shift makes sector-focused cross-selling both an opportunity and a risk.

Cross-selling in commercial lending isn’t just about offering a wider menu of products; it’s about understanding how sector trends shape a borrower’s capacity to perform. Financing a renewable energy installer, for instance, may open doors to supporting its logistics partners or technology providers. But without a disciplined view of sector risk, those same deals can leave portfolios exposed to volatile markets, overleveraged borrowers, or sudden policy reversals.

The most effective cross-sell strategies use industry data to identify where borrower demand is rising while applying clear credit guardrails. This approach enables lenders to deepen client relationships, capture safe growth opportunities and maintain portfolio resilience in a fast-changing market.

Why industry-level insights matter for cross-sell strategies

Successful cross-sell is not about offering more products. It is about offering the right products in the right sectors. Industry-level insights help underwriters see beyond individual borrower strength and identify where sector conditions are creating hidden risk or fresh opportunity. Without that lens, lenders can misjudge exposure, chasing growth in markets that look attractive on the surface but weaken under stress.

Sector shifts like investment cycles, regulatory changes, or innovation waves reveal where capital demand is rising. For example, a surge in healthcare technology spending signals new financing needs for digital platforms and medical devices. But those same trends may also mask over leverage, heavy capital expenditure cycles, or integration risk from rapid merger and acquisition activity. Similarly, renewable energy incentives may accelerate borrower demand, yet repayment capacity still hinges on volatile subsidies and long project lead times.

By aligning cross-sell outreach with sector momentum and sector guardrails, lenders can deepen client relationships while protecting portfolio stability. The goal is not to chase every high growth industry. It is to identify where growth and resilience overlap, ensuring expansion strengthens rather than strains the loan book.

Key signals an industry is ripe for lending expansion

Spotting lending opportunities requires more than identifying fast-growing sectors. For underwriters, the real test is whether growth trends translate into sustainable borrower capacity. Several signals help determine when a sector is primed for expansion and when caution is warranted.

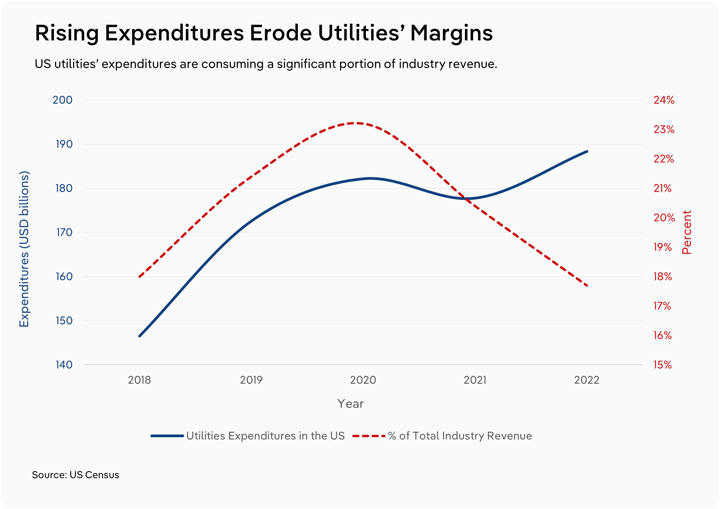

Revenue growth across key players

Consistent topline growth suggests rising demand and greater borrower confidence. For lenders, this often means stronger cash flow available for debt service. However, revenue growth alone is not enough. Credit teams must confirm that margins remain stable and that expansion is not fueled solely by short-term demand spikes.

Rising capital expenditures and merger activity

Sectors investing heavily in equipment, facilities, or technology upgrades typically signal strong growth prospects. At the same time, high capital spending and frequent merger activity can increase leverage and repayment risk. Stress testing these borrowers for repayment under less favorable conditions is essential.

Supply chain shifts and reshoring

Realignment of supply chains creates new financing needs in logistics, warehousing, and domestic production. Yet it also introduces execution risk, higher fixed costs, and potential delays. Credit teams should weigh new lending opportunities against these structural pressures.

Regulatory incentives

Government mandates or incentives often drive fresh capital demand in sectors like renewable energy or infrastructure. These policies can boost borrower pipelines, but they can also reverse unexpectedly. Lenders must test borrower repayment assumptions against potential policy changes.

Positive earnings trends

When businesses report strong profitability alongside revenue growth, they often have the stability to support new borrowing. This combination signals healthier creditworthiness. Still, underwriters should benchmark borrowers against sector medians to ensure results are not distorted by outliers.

High-potential industries for cross-selling expansion

Sectors that are undergoing structural change often create the most compelling opportunities for cross selling. As businesses adapt to regulatory shifts, technological disruption, or evolving consumer preferences, they require not only capital but also banking solutions that support treasury, risk management, and long term financing. For lenders, these environments offer a chance to deepen relationships and capture new revenue, but only if expansion is guided by sector benchmarks and disciplined credit practices.

Renewable energy

Renewable energy and electrification stand out as high-potential industries for cross-selling expansion, fueled by the global energy transition, aggressive climate policies and a landscape rich with investment incentives. As governments and corporations push for cleaner, more sustainable technologies, businesses across the sector are scaling up operations, building solar farms, upgrading grid infrastructure and investing in advanced storage solutions. These efforts require a broad mix of external financing, from construction loans to equipment leases and working capital for ongoing innovation. With policy support and public funding accelerating momentum, the appetite for credit solutions is only growing. This makes renewable energy and electrification prime territory for commercial lenders to introduce a wider range of products and services, deepening relationships with existing and new clients as the sector continues its rapid expansion.

In addition, cross-selling capabilities in the renewable energy sector are most advanced in regions with mature markets, common regulations and high investment, primarily in the US, EU and China, while emerging markets face challenges that restrict the scope and scale of cross-selling financial products and services. For example, regions such as the US and the EU benefit from coordinated regulations, allowing for more seamless cross-selling financing solutions. Shared legal frameworks and recognition of Renewable Energy Certificates make it easier for banks and financial institutions to bundle and cross-sell related services.

Cross-sell strategies in renewables:

- Bundle project finance with working capital facilities to support suppliers across the value chain.

- Offer advisory services that help clients remain compliant with government incentive programs.

- Extend equipment financing to downstream contractors that build and maintain renewable infrastructure.

Healthcare services & technology

Healthcare services and technology represent a prime growth area for cross-selling, propelled by powerful demographic and market forces. The sector is expanding rapidly as aging populations drive greater demand for medical care, while ongoing digital transformation introduces new healthcare delivery models and cutting-edge technologies. In this environment, providers and technology firms are not only investing in upgrades such as telehealth platforms, electronic medical records and medical device innovation but are also actively navigating a wave of mergers and acquisitions aimed at scaling up and integrating services.

These trends create a sustained need for financing, from funding for health IT infrastructure and facility expansions to acquisition loans and working capital solutions. Regional disparities in healthcare cross-selling stem primarily from variations in infrastructure, market access and population needs. For instance, countries with uneven distribution of healthcare facilities face challenges in addressing unmet health service and medication needs due to the limited availability of healthcare providers in remote areas. However, developed markets with robust insurance penetration and sophisticated data analytics, show greater potential for targeted cross-selling through machine learning and predictive modeling.

Cross-sell strategies in healthcare:

- Pair acquisition financing with integration support credit lines to help borrowers stabilize after mergers.

- Provide equipment leasing structures that allow healthcare firms to upgrade technology without heavy upfront costs.

- Deliver cash management solutions designed for hospitals or clinics that face fluctuating reimbursement cycles.

Logistics & warehousing

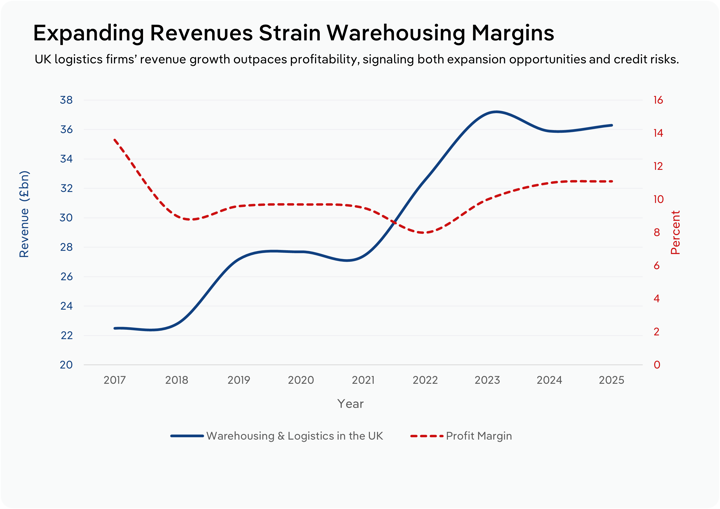

Logistics and warehousing are emerging as major hotspots for cross-selling expansion thanks to the ongoing surge in e-commerce, widespread supply chain realignment and significant infrastructure upgrades. As businesses seek faster delivery times and greater supply chain resilience, many are investing in new distribution centers, warehouse automation and advanced inventory systems. Realignment efforts, such as reshoring and the expansion of fulfillment networks, further boost demand for construction loans, equipment financing and working capital solutions.

With infrastructure spending on the rise and digital technologies transforming how goods are tracked and moved, both established logistics providers and growing e-commerce players present abundant opportunities for lenders to introduce tailored financial products and deepen relationships in a sector that is rapidly expanding and reinventing itself. Cross-selling opportunities in the logistics and warehousing sector vary globally, with advanced regions supporting more sophisticated and integrated offerings, while developing markets encounter limitations due to infrastructure and regulatory differences. Regional warehousing strategies drive cross-selling opportunities by optimizing delivery, costs and customer experiences according to local needs and capabilities.

Cross-sell strategies in logistics:

- Combine real estate lending with equipment financing to support automation and modernization of facilities.

- Offer working capital facilities tailored to fast-growing e-commerce companies that need liquidity to scale.

- Use sector-wide insights to help clients right-size warehouse and distribution capacity during supply chain shifts.

Mitigation strategies for risky cross sell

Cross-sell initiatives can accelerate growth and deepen client relationships, but they also expand exposure in ways that traditional credit processes may not fully capture. Sector dynamics, policy dependence, and capital intensity all create hidden correlations that can magnify losses if left unchecked. To balance opportunity with discipline, lenders need a playbook of sector-aware safeguards that keep underwriting sharp, stress testing relevant, and portfolio governance proactive.

Tighten underwriting in policy-sensitive sectors

Start by raising the bar where borrower performance depends on government support. Renewable energy is a clear example. Incentives and subsidies create healthy pipelines, but repayment capacity can hinge on timelines that shift. Build models that remove or delay subsidies and test whether cash flow still covers debt service. Require stronger equity cushions and clearer contingency plans for construction delays or interconnection bottlenecks.

Build sector-specific stress tests for CapEx and M&A intensive borrowers

Industries with heavy capital spending or consolidation can look strong at the topline while leverage and integration risk creep higher. Healthcare technology and logistics are common cases. Run scenarios that lengthen reimbursement cycles, lift labor costs, or raise vacancy in warehousing. Translate each scenario into liquidity runways, revised debt service coverage, and covenant headroom so you can see how quickly a good file can slip.

Set dynamic exposure limits where volatility is rising

Concentration limits should move with sector risk. Use external indicators such as vacancy rates, order backlogs, or policy milestones to tighten or relax exposure caps by region or subsector. Lower caps in markets showing deteriorating fundamentals so you avoid stacking correlated risk while momentum is still positive at the borrower level. Re-evaluate limits on a fixed cadence so adjustments are timely and defensible.

Calibrate monitoring frequency to sector risk profiles

Do not treat all cross-sell credits the same after closing. Mature, stable industries may justify annual reviews. Fast-changing sectors warrant quarterly or even monthly reads on leverage, liquidity, backlog, and benchmark comparisons. Shorter intervals surface early warnings that financial statements alone can miss, giving you time to nudge terms, add collateral, or pause incremental lending.

Document assumptions and pre-approved committee triggers

Embed the sector view into your credit memo and record the exact assumptions that underpin repayment. Tie those assumptions to clear triggers such as subsidy step-downs, reimbursement changes, or vacancy thresholds. Pre-approve actions that follow if a trigger is hit, including tighter advance rates, reduced revolver availability, or a hold on new commitments. This turns sector insight into concrete governance that protects the portfolio while you pursue cross-sell growth.

Final Word

Cross-selling in commercial lending is most effective when it balances opportunity with portfolio discipline. Expanding into high-growth sectors can strengthen client relationships and boost revenue, but without industry guardrails, these loans can quickly undermine credit quality. The strongest strategies rely on sector benchmarks to confirm whether borrower leverage, margins, and repayment capacity align with industry medians, while stress testing ensures assumptions hold if policy incentives fade, costs rise, or demand shifts. Exposure caps provide further protection, preventing overconcentration in hot sectors and preserving the flexibility to rebalance when conditions change.

Equally important is treating cross sell as more than a single loan opportunity. By pairing growth lending with complementary services such as working capital facilities, equipment finance, and treasury solutions, lenders can capture multiple revenue streams while supporting clients through different stages of expansion. When sector insights are embedded into these strategies, underwriters can deliver both growth and resilience, strengthening portfolios while maintaining the discipline that protects credit quality.