Key Takeaways

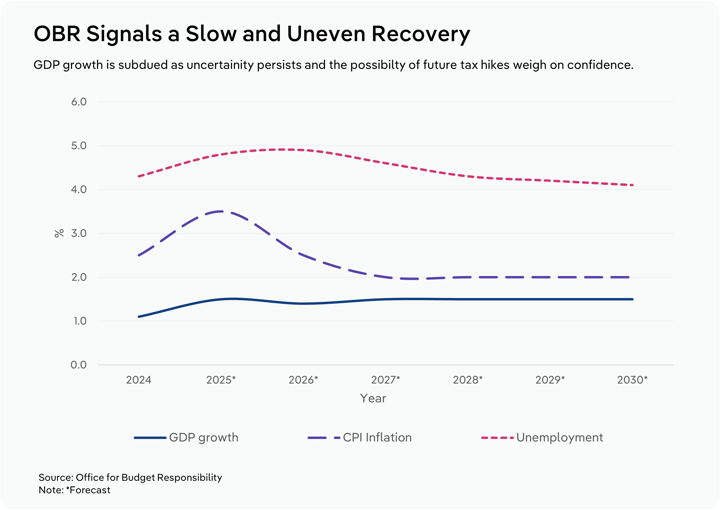

- Measures outlined in the Budget mean that UK GDP growth is expected to remain fairly steady over the five years through 2030-31. However, forecast have been downgraded compared to previous estimates as UK productivity underperforms.

- Higher-than-desired inflation is anticipated to stick around as efforts to cut household bills aren’t enough. Combined with lower GDP growth, the pre-measure fiscal position was tight, but tax hikes are offsetting spending increases.

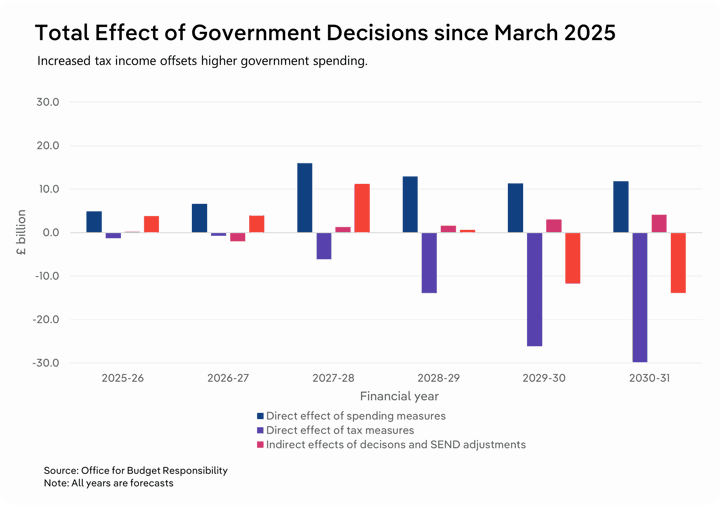

- Rather than a sweeping tax system overhaul, the Chancellor has made targeted decisions to raise funds, combined with strategic spending commitments. This has created some big winners and losers.

On 26 November 2025, the Chancellor of the Exchequer, Rachel Reeves, delivered the 2025 Autumn Budget. It outlined the government’s plans for fuelling economic growth, assisting working people and restoring public finances.

The budget has been delivered amid 12 months of challenging economic conditions for a wide range of UK industries. The Office for National Statistics (ONS) reports that consumer price inflation has remained above the Bank of England’s 2% target since October 2024, standing at 3.6% in the 12 months to October 2025, denting both household spending and business profit levels. Real GDP has also been weak, following a downward trend since April 2025 and only growing by 0.1% in the three months to September 2025. At the same time, the UK unemployment rate has been enduring upward pressure, inching up by 0.3 percentage points to 5% over the three months through September 2025, as stated by the ONS.

The economic backdrop behind the budget

The Office for Budget Responsibility (OBR) has responded to the Chancellor’s announcement with the latest economic and fiscal forecast for the five years to 2030-31, providing critical insight into how these changes are expected to affect the performance of UK industries.

The independent spending watchdog forecasts GDP to grow by 1.5% in 2025, a 0.5% hike from its March prediction and above the 1.1% growth seen in 2024. This revision to the estimate has been driven by stronger-than-expected growth in the second half of 2024 and the first half of 2025, resulting from temporary front-loading ahead of Stamp Duty changes and tariff increases.

The OBR then anticipates GDP to reach 1.4% in 2026, followed by 1.5% for each subsequent year until 2030. This is a downgrade from previous estimates, resulting in an average GDP growth rate of 1.5% over the next five years, 0.3 percentage points lower than forecast in March 2025. The key driver behind this poorer outlook is the OBR’s downgrade in medium-term productivity growth, resulting from historical underperformance.

Sticky inflation is expected to continue to exert pressure on profit. The OBR has increased its inflation prediction for 2025 to 3.5%, from 3.2% in March. The watchdog also predicts that it won’t return to the 2% target until 2027, with inflation reaching 2.5% in 2026, up from its previous 2.1% prediction in March. With cost pressures lingering, businesses may decide to delay investment decisions in order to shield profit. While efforts in the Budget to lower energy bills in 2026 will help to cut costs, they don’t go far enough, with the OBR noting that higher food and services prices overwhelm these measures.

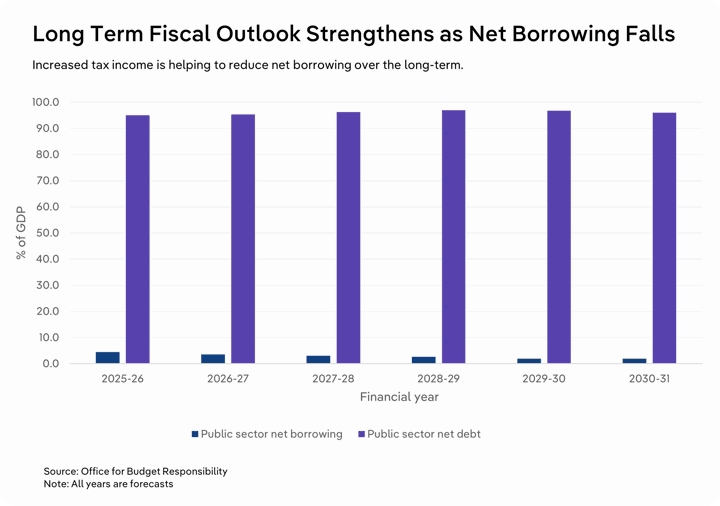

Additionally, lower GDP growth combined with higher-than-expected inflation and a rise in government spending reduced the OBR’s expectations for the government’s pre-measures fiscal position. However, tax increases introduced in the Budget more than offset spending increases in the final years of the forecast, resulting in a primary surplus of £21.7 billion in 2029-30. This would be double the buffer to the Chancellor’s stability rule that was stated in the previous budget–that the current budget should be on course to be in balance or surplus by 2029-30, reducing uncertainty for businesses.

Taxes

A core focus of the budget has been tax reform. The Chancellor has sought to increase tax receipts without raising the headline rate of Income Tax, VAT and National Insurance (NI). Instead, an effective “stealth tax”, combined with other changes, will raise a total of £26 billion in 2029-30.

Income Tax and NI thresholds have been frozen for another three years beyond the 2028-29 tax year. The OBR comments that this will drag over 1.7 million people into higher Income Tax thresholds by 2029-30, generating £8 billion. Furthermore, the freezing of employer NI thresholds will increase costs for businesses as wages rise over time, potentially making hiring unattractive.

Previously, the amount that individuals could “sacrifice” from their salary and contribute to their pensions without paying NI was unlimited. The Budget now mandates a cap on these National Insurance-free contributions at £2,000 from 2029. The OBR reports that this move is expected to raise £4.7 billion in 2029-30.

From April 2026 onwards, the basic and higher rates of tax on property, dividends and savings income will increase by two percentage points each. Additionally, from April 2028, a new high-value council tax surcharge will be introduced, with properties worth more than £2 million being charged £2,500 a year, while homes over £5 million will pay £7,500 annually.

Other tax changes include a reduction to the writing down allowance main rate in corporation tax and a cut to capital gains tax relief on disposals to employee ownership trusts. Furthermore, remote gaming duty will increase to 40% from April 2026 and the general betting duty will swell to 25% online from April 2027. A new mileage-based tax for electric vehicles and plug-in hybrids will be introduced from 2028, when an extension to the sugar tax will be also implemented. Additionally, the tax on alcohol and tobacco will continue to rise – tax on alcohol, including draught drinks, will increase by the higher RPI rate of inflation in February 2026 while tobacco tax will grow by 2% above the higher RPI measure. The OBR comments that overall, these tax policies will deliver the third-largest medium-term tax increases since the OBR was established in 2010.

Public spending

The increases in taxes have been peddled by the government as necessary, given its plan to increase public spending. Some of these changes have been announced since the Spring Statement 2025 due to reversals or changes to welfare policies. These include the reintroduction of winter fuel payments in June, the July reversal of the tightening of Personal Independent Payments and increases to the value of the Universal Credit health element in July. The OBR expects these changes alone to raise spending by £6.9 billion in 2029-30.

The Budget also confirms new public spending commitments. A significant announcement was the removal of the two-child Universal Credit limit from April 2026, which the government expects to boost 560,000 families’ Universal Credit award in 2029-30, removing 450,000 children from child poverty. This decision is anticipated to increase spending by £3 billion in 2029-30, according to the OBR.

Other public spending announcements include £5 million dedicated to providing libraries in secondary schools, a freeze on single NHS prescription costs in England for another year and proceeding with plans for up to 250 neighbourhood health centres in England, 120 of which should be operational by 2030. Additionally, the statutory override of local government deficits resulting from the costs of special educational needs and disabilities provision has been extended until the end of 2027-28.

On the employment side, training for apprentices under 25 will be made free for small and medium-size companies. Additionally, those aged 18 to 21 who are on Universal Credit and not in work or education for more than 18 months will be provided with six-month paid work placements.

Energy and infrastructure

With economic growth a priority under this budget, the government announced major investment plans for UK infrastructure. The Budget revealed that two AI Growth Zones will be housed in Wales, creating 8,000 jobs, supported by a £10 million investment into the semiconductor sector. Further funds were unveiled for Scotland, with £14.5 million allocated for low-carbon technologies in Grangemouth, £20 million to renew infrastructure in Inverclyde and £20 million to upgrade Kirkcaldy's town centre and seafront. The government also committed £900 million to complete the publicly funded works for the Lower Thames Crossing.

Household spending has been restricted over the past five years, with high energy bills putting a dent in disposable income. To tackle the high cost of living and help reduce household bills, the government announced that it would scrap the Energy Company Obligation, a home insulation programme funded through bills, alongside providing funds to cover 75% of the domestic costs of the legacy Renewables Obligation for three years. The Chancellor stated that these measures would save households an average of £150 on their energy bills from April 2026. However, the OBR highlights that these choices will only lower inflation by 0.3 percentage points from 2026.

The 5p cut in fuel duty has been extended once again from its “temporary” implementation in 2022, with it remaining frozen until September 2026 and then rising in a staggered approach from April 2027. This strategy has been implemented to keep costs under control for households; however, a new charge on electric vehicle mileage has been introduced to offset anticipated lost government earnings. While the fuel duty cut bodes well for petrol stations, sites will be required to report their prices in early 2026 with the introduction of the Fuel Finder, a live fuel price data tracking system available to consumers via motoring apps, to help customers locate the best deals. The costly compliance of keeping price data up to date will likely dent petrol stations’ profit unless passed on to customers.

Other key announcements

The National Living Wage (NLW) is set to rise again in April 2026; the rate for those aged over 21 will increase from £12.21 to £12.71, a 4.1% hike, while the wage rate for 18- to 20-year-olds will climb by 8.5% from £10 to £10.85. These increases are higher than many expected as the Chancellor seeks to improve household budgets. This will pile even more pressure on businesses after they endured NLW and NI hikes in April 2025. Industries that rely on minimum wage workers will be the most affected, such as hotels, restaurants and pubs. On the other hand, 750,000 retail, hospitality and leisure properties are benefitting from a permanent business rate relief cut.

Other announcements include a one-year freeze on regulated rail fares in England from 2026 and the removal of the tax exemption for small packages from overseas retailers worth under £135 from 2029. Additionally, mayors in England have been granted the necessary powers to tax overnight stays in hotels and holiday lets.

Top 5 industries most affected

Hotels

Although the hospitality and leisure sectors as a whole will take a hit from the budget, the hotels industry is facing challenges from multiple angles. In addition to the 4.1% increase for the National Living Wage for over 21s, the green light has been given for tourist taxes on overnight stays in English cities. This will put extra strain on profit, introducing both rising costs and the potential for revenue to drop as demand weakens. While some sites may benefit from the permanent reduction in business rates, overall, the changes brought by the budget place added strain on the industry. UKHospitality notes that overall, the wage increases represent a total of £1.4 billion in additional costs for the hospitality sector, which it states will ultimately be passed on to the consumer, as hospitality businesses have reached their cost absorption limit. Higher prices won’t just fuel inflation but also weaken demand, compounding the industry’s troubles by dealing a blow to revenue.

Gambling & betting activities

Gambling has been one of the Chancellor’s major focuses to generate tax revenue in the Budget. From April 2026, the rate of Remote Gaming Duty will increase from 21% to 40%, affecting providers of online, TV, radio and other remote betting services, including online casinos. Additionally, a new rate of General Betting Duty is being introduced from April 2027, placing a 25% charge on all remote betting, except for horse racing, in line with the rate for land-based betting. The government states that these changes will raise over £1 billion per year. An increased tax burden will ultimately reduce revenue for gambling providers unless these costs are passed on to consumers. The OBR expects that gambling businesses will pass through around 90% of the duty increases, with the higher prices likely to pick away at demand. Companies face a tricky balancing act between raising prices to offset profit cuts, while minimising the shock to demand and revenue. The Betting and Gaming Council has responded by stating that these tax rises will undermine jobs, investment and growth across the UK and push more consumers to the unregulated black market to cut costs.

Alternatively fuelled vehicle manufacturing

With fuel duty being frozen once again until September 2026 and more people moving from petrol to electric cars, the UK government has turned its attention to electric vehicles in an effort to offset lost revenue. The result of this is a tax on electric vehicle users depending on their mileage. From April 2028, electric car drivers will pay a road charge of 3p per mile and plug-in hybrid users 1.5p per mile, with the rate rising annually in line with inflation. The charges will increase the lifetime cost of purchasing an electric vehicle, potentially denting sales for manufacturers. The OBR expects there to be 440,000 fewer electric car sales across the next five years due to these measures. While it also anticipates an increase of 320,000 electric car sales due to other measures, such as the electric car grant, this still means a net decline of 120,000 sales compared to its forecasts before the budget. Fewer sales don’t bode well for future revenue growth potential.

Soft drinks manufacturing

The government has decided to extend the scope of the Soft Drinks Industry Levy, which was introduced in 2018. It argues that the initial levy was a huge success, leading to a 47% average reduction in sugar in soft drinks covered by the levy between 2015 and 2024. However, with sugar intake in the UK still above recommended levels, the government believes further measures are an effective way to improve consumers' health. From January 2028 the threshold for the levy will be lowered from 5g of sugar per 100ml to 4.5g, while the current exemption for milk-based drinks and milk substitutes with added sugar will be removed. The government expects the changes to the levy to raise between £40 million and £45 million a year. While this move will create additional cost burdens for soft drink manufacturers, British Soft Drinks has been widely positive about the move, as the threshold wasn’t lowered as far as the original proposal of 4g per 100ml. Still, it’s likely to bring additional costs for the industry, denting profit unless passed on to consumers. However, brands could also choose to alter product recipes to avoid the tax, with the added benefit of winning over customers in search of products with better health credentials.

Semiconductor & circuit manufacturing

Economic growth has been at the forefront of the UK government’s priorities and with labour productivity expectations being reduced by the OBR due to historic underperformance, the Chancellor has bet on artificial intelligence to boost productivity and improve GDP growth. To support this, the government has announced initiatives for businesses in the science and technology sector, including research and development packages, as well as investment opportunities for entrepreneurs. The semiconductor and circuit manufacturing industry has been a big winner in these announcements, with the government revealing a £10 million investment for the industry in South Wales to maximise growth opportunities from the AI Growth Zone. This direct injection of funds will boost revenue potential, while additional investment up the supply chain will provide long-term support for demand.

Final Word

Overall, the general business climate has been able to breathe a small sigh of relief, as the Budget’s commitment to meeting its stability rules has eliminated uncertainty for many. However, this has come at the cost of a tax hike in all but name, as frozen thresholds will result in both individuals and businesses paying more as earnings rise over time. A more targeted approach in place of sweeping reforms has created some losers, with the hospitality, gambling and electric vehicle manufacturing industries being some of the hardest hit. On the other hand, economic growth is set to be higher this year than many expected and even though the UK’s labour productivity has been downgraded, the Chancellor appears determined to beat expectations, with investments in emerging technologies a positive start.