Key Takeaways

- Fragmented data slows decisions, weakens trust, and increases operational and regulatory risk as organisations scale.

- Integration delivers the most value when industry intelligence flows directly into the systems where credit, strategy, and client decisions are made.

- Connected, governed data supports faster adoption, cleaner governance, and future-ready workflows without repeated rework.

I spend a lot of time with data leaders who are trying to make their systems work harder for the business. They have invested in cloud platforms, BI tools, governance frameworks and all the right people. Yet almost every conversation ends up in the same place. The organisation has plenty of data, but it still struggles to get reliable insight into the hands of the people who need it.

What usually holds things back is not the technology itself. It is the gaps between systems. Data that sits in one platform but not another. Data that lives in a PDF instead of the CRM. Analysts who spend their mornings stitching sources together instead of answering real questions. Leaders who open three dashboards and see three different stories.

These are smart organisations with strong teams. But fragmentation slows everything down. It erodes trust and makes even simple decisions feel heavier than they should be. When external and internal data flow together, something important changes. Governance becomes simpler. Context no longer needs to be rebuilt. Analysts spend more time analysing. Executives stop questioning which numbers to trust.

The organisations that get this right move faster and operate with far more confidence. Not because they have more data, but because their data is connected, governed, and available exactly where decisions are being made.

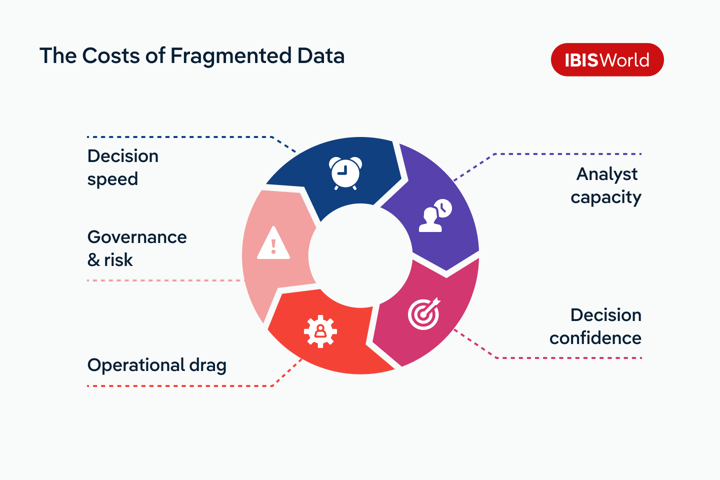

What disconnection really costs the business

One of the most common misunderstandings I see is the idea that fragmented data is mainly a productivity issue. Something that slows teams down but does not materially affect outcomes. In practice, disconnection reaches much further into the organisation. It shapes how quickly decisions are made, how confidently leaders act, and how much risk the business is carrying without realising it.

When systems do not connect cleanly, the cost is not theoretical. It shows up every day.

Decision speed

When data is scattered across CRMs, BI tools, spreadsheets, and legacy systems, even straightforward questions require coordination. Analysts extract data from multiple sources, reconcile differences, and validate assumptions before anyone feels comfortable acting on the output. What should be a short cycle becomes a drawn-out process.

That delay matters. Credit decisions take longer than they should. Market assessments arrive late in planning cycles. Risks surface after positions have already been taken. Over time, organisations that cannot move at the pace of the market fall behind, not because they lack insight, but because insight arrives too slowly.

Analyst capacity

I regularly see highly skilled analysts spending most of their time recreating context rather than applying judgement. Industry benchmarks are pulled from old decks. Data is copied out of static reports. Models are rebuilt because original inputs cannot be reused or trusted across teams.

Each group develops its own approach because it feels safer than relying on shared sources. That behaviour is understandable, but it does not scale. Shadow systems multiply. Excel becomes the safety net when confidence in upstream systems is low. The organisation becomes dependent on individuals who understand how everything fits together, rather than on systems that make that understanding repeatable.

Decision confidence

When each department operates from its own version of the data, confidence erodes quickly. Leaders see different answers to the same question depending on who prepared the analysis and which systems were used. Meetings shift away from decision-making and toward reconciling assumptions, definitions, and timing.

This erosion of confidence compounds over time. Even when strong data exists, its influence diminishes because trust is no longer implicit. Decisions take longer, escalation becomes more common, and the organisation behaves more cautiously than the underlying information warrants.

Governance and risk

Disconnected systems also make governance harder than it needs to be. Without consistent lineage, metadata, and update processes, it becomes difficult to answer basic questions about where data came from, how current it is, and how it is being used.

For regulated industries in particular, this creates tangible risk. Audit preparation becomes manual and time-consuming. Compliance teams rely on point-in-time checks rather than continuous assurance. Data leaders spend more time responding to issues than building systems designed to prevent them.

Operational drag

The effects of disconnection are visible in operational metrics. Time to insight stretches from hours to weeks as teams extract, reconcile, and validate data across systems. Audit findings increase as data handling becomes harder to track. Data initiatives struggle to demonstrate ROI because efficiency gains never fully materialise.

The larger cost often sits outside the metrics. When data cannot move reliably through the organisation, businesses struggle to respond to change, adapt strategy, or act with conviction. Over time, that lost momentum compounds, and the gap between fast-moving competitors and everyone else becomes harder to close.

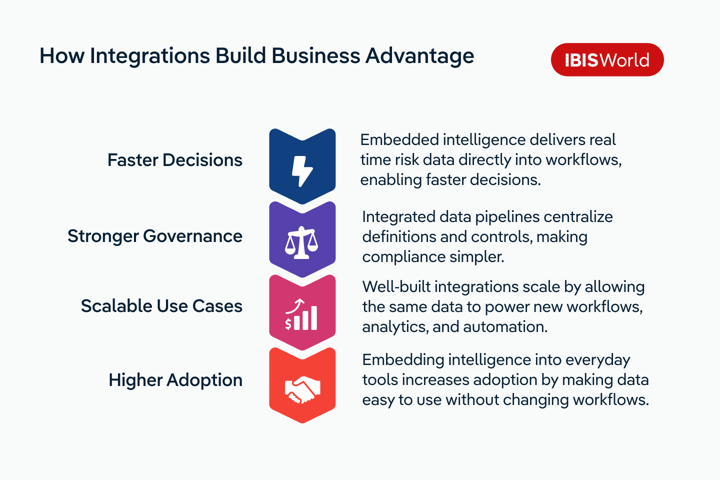

Four ways integration builds business advantage

Integration creates advantage when it changes how the business operates, not just how data is stored. When external and internal data move together through core systems, organisations become faster, more consistent, and easier to scale.

1. Faster decisions

The first advantage is speed. When industry intelligence flows directly into systems, teams no longer need to stop and search for context. This is where I see the biggest practical impact. Credit teams pull current industry risk data straight into lending models instead of sourcing it manually. Sales teams see benchmarks and trends inside their CRM while preparing for client conversations and creating credit reports. Analysts spend their time interpreting signals and corroborating rather than moving data between systems. Decisions happen faster because the data needed to support them is already in place.

2. Stronger governance

Integration strengthens governance when it is designed into the data pipeline. Shared definitions, consistent update schedules, and clear lineage make it easier to understand where data comes from and how it is being used. This reduces day-to-day complexity. External data arrives in a structured, system-ready format, making it easier to audit, monitor, and control. Compliance becomes simpler because the data is managed once, centrally, rather than recreated across teams and tools.

3. Scalable use cases

A well-built integration scales. Once industry intelligence is embedded into core platforms, it can support new workflows without requiring rework. The same data that feeds credit decisions can also power forecasting, portfolio monitoring, client reporting, or automation. Integrations that deliver machine-readable, governed data make it far easier to support AI, real-time monitoring, and new analytics as the business evolves.

4. Higher adoption

Data only delivers value when people actually use it, and usage drops quickly when access is cumbersome or inconsistent. When industry intelligence appears inside the tools teams already rely on, adoption follows naturally. Analysts trust the data because it is current and consistent. Business users engage with insights because they do not need to learn new platforms. Over time, confidence in both the data and the systems that deliver it continues to build.

Final Word

The organisations that get the most value from data are not the ones collecting the most of it. They are the ones that have designed their systems so information moves reliably to the point of decision.

Fragmentation is rarely the result of poor intent or weak technology. It is usually the byproduct of growth, legacy choices, and teams solving problems in isolation. Over time, those choices add friction, slow decision-making, and quietly increase risk.

Integration changes that trajectory. When external industry intelligence flows directly into core systems, the organisation operates with more speed, consistency, and confidence. Analysts stop rebuilding context. Governance becomes simpler rather than heavier. Leaders make decisions knowing the data in front of them is current, consistent, and defensible.

This is why we focus so heavily on integration at IBISWorld. Our role is not just to provide industry insight, but to deliver it in a form that works inside modern enterprise architectures. Structured, governed, and ready to plug into the platforms teams already rely on.

The businesses that invest in this foundation today are better positioned for whatever comes next. Whether that is automation, AI-driven decisioning, or new regulatory pressure, connected data creates optionality. And in complex environments, optionality is a real competitive advantage.